Understanding Brokerage Recommendations

When pondering the latest recommendations from Wall Street analysts, one must tread lightly. These recommendations, ranging from Buy to Strong Sell, are a hot topic among investors eager to discern the future of companies such as Beazer Homes (BZH).

The Brokerage Verdict on Beazer

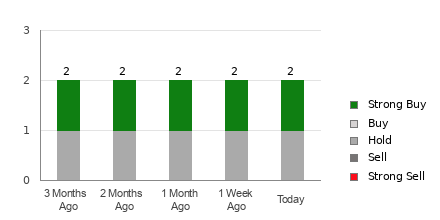

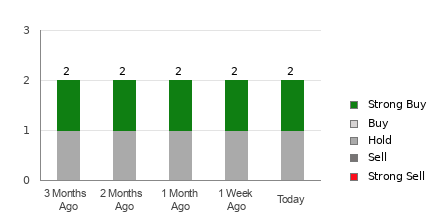

The current average brokerage recommendation (ABR) for Beazer stands at a solid 2.00, implying a Buy sentiment among brokerage firms. Of the four recommendations contributing to this ABR, a notable 50% advocate a Strong Buy position.

Brokerage Recommendation Trends for BZH

Check price target & stock forecast for Beazer here>>>

Cautiously Interpretating Brokerage Advice

However, relying solely on brokerage recommendations for investment decisions can be perilous. Studies have shown that analysts often exhibit a strong positive bias due to their employers’ vested interests, skewing their views towards positivity. For every “Strong Sell” rating, there are five “Strong Buy” ratings, showcasing the inherent optimism of these analysts.

In such a landscape, it is prudent for investors to utilize the ABR cautiously and complement it with other analytical tools. One such tool of note is the Zacks Rank.

The Power of Zacks Rank

Zacks Rank, a data-driven stock rating mechanism, offers valuable insights into a stock’s potential performance. Categorized from #1 (Strong Buy) to #5 (Strong Sell), this tool leverages earnings estimate revisions to predict future stock movements accurately.

ABR vs. Zacks Rank

While the ABR is solely influenced by brokerage recommendations and can be skewed, the Zacks Rank relies on concrete data like earnings estimate revisions. This distinction ensures a reliable and unbiased analysis of a stock’s outlook.

Deciphering Beazer’s Future

When evaluating Beazer, it’s crucial to consider all factors, including earnings estimate revisions and the steady consensus estimate. With a Zacks Rank #3 (Hold), Beazer’s future performance remains a topic of interest. It might be wise for investors to exercise caution given the current market dynamics.

For those intrigued by the realm of investing, exploring the Top 10 Stocks for 2024 might unveil hidden gems. Leveraging analysis tools like the Zacks Rank can aid in making well-informed investment decisions.

Access the latest recommendations from Zacks Investment Research here

Please note that the opinions stated here are solely those of the author and not necessarily reflective of Nasdaq, Inc.