Decoding Wall Street’s Sentiment

Investors often turn to analyst ratings for guidance on stock decisions. But are these Wall Street opinions a reliable compass for investments?

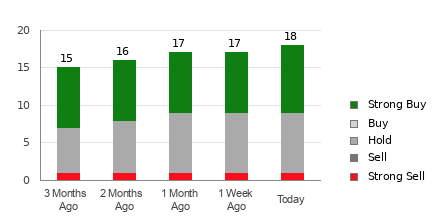

Currently, D.R. Horton (DHI) boasts an average brokerage recommendation (ABR) of 2.00, reflecting a “Buy” sentiment from 20 brokerage firms. Among these recommendations, 50% are Strong Buy, while 10% are Buy.

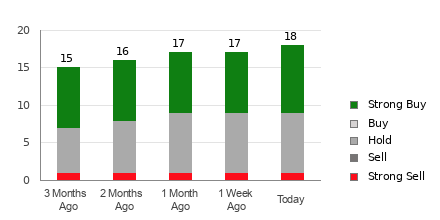

Brokerage Recommendation Trends for DHI

Check price target & stock forecast for D.R. Horton here>>>

While the ABR points to a Buy recommendation for D.R. Horton, empirical studies raise questions about the reliability of these suggestions in predicting stock performance.

Brokerage analysts are often swayed by their firms’ interests, leading to biased ratings. For every “Strong Sell” rating, there are typically five “Strong Buy” ratings, skewing the perceptions of retail investors.

The Power of Zacks Rank

For a more grounded approach, the Zacks Rank offers a robust evaluation tool. Dividing stocks into five categories, from Strong Buy to Strong Sell, it provides insights based on earnings estimate revisions, a reliable indicator for near-term stock performance.

Zacks Rank Should Not Be Confused With ABR

While both ABR and Zacks Rank use a 1-5 scale, they differ significantly. ABR relies on brokerage recommendations, while Zacks Rank leverages earnings estimate revisions for its assessments.

Investment Wisdom: Earnings Outlook

Despite a stable Zacks Consensus Estimate of $14.19 for D.R. Horton in the current year, the stock holds a Zacks Rank #3 (Hold). This rating reflects analysts’ steady earnings predictions, hinting at consistent market performance in the short term.

Hence, caution is advised when interpreting the Buy-equivalent ABR for D.R. Horton.

Ready to explore more investment opportunities? Discover the latest stock trends with Zacks Investment Research: