The ABR Conundrum

Stock traders often lean on analyst advisories when contemplating market maneuvers. Media buzz surrounding brokerage evaluations can undoubtedly sway stock prices, but does this hullabaloo hold weight?

Before diving into the veracity of brokerage recommendations and leveraging them for financial gain, let’s delve into the current sentiments of Wall Street towards Lamb Weston (LW).

Wall Street’s Verdict on LW

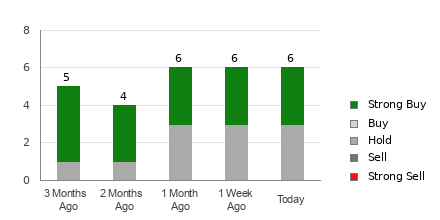

With an average brokerage recommendation (ABR) of 1.22 – sandwiched between a Strong Buy and Buy on the 1 to 5 scale – conferred by nine brokerage cadres, the outlook for Lamb Weston looks rosy. As a matter of fact, a staggering 88.9% of all recommendations tip towards a Strong Buy status.

Should we put all our beans in this basket, though? Studies suggest that these brokerage blessings may not always lead to the pot of gold at the end of the rainbow. Analysts tend to sport rose-tinted glasses when their firm is hitched to a stock, often manifesting as an overflowing pitcher of Strong Buy recommendations for every sprinkle of Strong Sell caution.

It’s crucial not to play the fiddle to their tune but rather use this data as a seasoning to your own investment recipe or pair it with a trusty tool that’s proven its mettle in predicting market moves accurately.

Tapping the Zacks Rank

Cue Zacks Rank – a trusted stock evaluation tool with a sterling reputation and a knack for foreseeing market dynamics. This nifty model categorizes stocks into five brackets, from Strong Buy to Strong Sell, painting a lucid picture of a stock’s trajectory. Cross-referencing the ABR with Zacks Rank could steer you on a profitable course.

ABR vs. Zacks Rank: The Plot Thickens

While both ABR and Zacks Rank titillate in the 1-5 realm, their cores dance to different tunes. ABR rides on brokerage insights; Zacks Rank waltzes to earnings estimate revisions’ rhythm. Analyst whimsy often flavors ABR ratings, whereas Zacks Rank relies on hard data – earnings trends.

And guess what? Data doesn’t lie. Whisperings of earnings revisions have a melody that resonates deeply with stock price symphonies. Zacks Rank, driven by these financial whispers, heralds a more reliable forecast compared to brokerages’ crystal balls.

When it comes to timeliness, Zacks Rank takes the crown. Earnings estimate revisions paint a vivid picture of a stock’s future, synchronized with market ebbs and flows, leaving ABR in the rearview mirror of relevancy.

Is LW a Diamond in the Rough?

Peering into the earnings estimate Trojan horse, Lamb Weston holds steady ground with a Zacks Consensus Estimate at $5.94 for the year, unmoved for the past moon’s cycle. This echoes analysts’ guardedly optimistic sentiments, reflecting in a Zacks Rank #3 (Hold) for the stock. A moderate approach might be the key to unlocking LW’s potential amidst the market clamor.

So, are you ready to dance with the wolves of Wall Street, or will you tread lightly on the ABR’s enchanted shores? The decision lies at the crossroads of data and discernment.

Stay Informed, Stay Ahead

For those yearning for market prowess, the Zacks Top 10 Stocks for 2024 await those who dare to seize the reins of financial fortune. Crafted by the maestro himself, Sheraz Mian of Zacks, this selection has outshone the S&P 500, nearly tripling its gains. Are you ready to ride the wave of success? Dive into the pool of potential with these quintessential picks.

Embrace wisdom, navigate through the ever-shifting walls of finance, and harness the tools that illuminate the path to prosperity.

Remember, in the realm of investments, unity of knowledge and sagacity is the elixir that transforms the mundane into the miraculous. Choose your moves wisely, and may the winds of Wall Street carry you to the shores of success.

Will Lamb Weston be your beacon of light in the stormy seas of market volatility? The answer, dear reader, lies within the depths of your analysis and the compass of your intuition.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.