As reported by Fintel on February 26, 2024, Leerink Partners made a bold move by initiating coverage of Cencora (NYSE:COR) with an enthusiastic Outperform recommendation that set the stage on fire.

Analyst Price Forecast Indicating 7.60% Upside Potential

Recent data as of February 24, 2024, shows that the average one-year price target for Cencora stands at 256.49. Projections span from a low of 226.24 to a dazzling high of $280.35. This optimistic outlook points to a 7.60% rise from the latest closing price of 238.37.

Join the leaderboard to catch companies with the greatest potential for price target upsides.

Cencora is anticipated to rake in an annual revenue of 277,270MM, an impressive increase of 2.10% in its trajectory. The estimated annual non-GAAP EPS stands at a robust 13.00.

Delving into Fund Sentiments

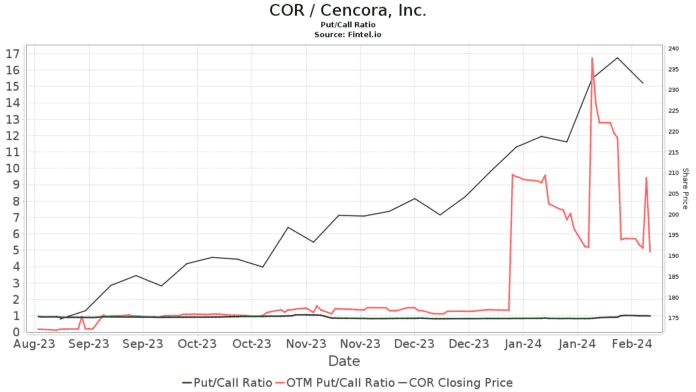

The investment landscape for Cencora sees a significant 108 new owners or a 5.80% surge in institutions or funds holding positions in the company, tallying up to an impressive 1970 entities. On average, the portfolio weight carved out for COR amounts to 0.39%, marking a slight drop of 0.89%. Institutional stakes have soared by 3.99% in the last quarter to reach 194,599K shares.  The put/call ratio currently at 0.87, paints a rosy outlook for the future of COR.

The put/call ratio currently at 0.87, paints a rosy outlook for the future of COR.

Monitoring Other Shareholders’ Moves

Price T Rowe Associates has taken a decisive stance by securing 10,706K shares, which translates to a significant 5.37% stake in the company. Their recent filing reflects a positive uptick as they escalated their holding by 3.17%, marking a notable 8.06% surge in their allocation towards COR over the preceding quarter.

Jpmorgan Chase is another player in the game, holding 5,457K shares equating to a 2.74% ownership of Cencora. However, their recent actions show a downturn with a 21.24% decrease in shareholding compared to the prior filing. Their allotment towards COR has dipped by 18.03% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares retains 5,318K shares, reflecting a 2.67% ownership in Cencora. Nonetheless, there has been a minor decline of 0.79% in their stake, leading to a 3.69% reduction in portfolio allocation towards COR over the recent quarter.

Boston Partners asserts its position with 4,033K shares totalling a 2.02% ownership in the company. However, their recent actions unveil a dramatic decrease of 21.98% in shareholding compared to the prior period, resulting in a substantial 64.38% pullback in their allocation towards COR.

VFINX – Vanguard 500 Index Fund Investor Shares manages 4,006K shares, presenting a 2.01% ownership in Cencora. Their recent filing signals a hike as they increased their holding by 3.73%, yet their portfolio allocation towards COR dipped marginally by 0.53% over the past quarter.

A Glimpse into CoreSite Realty

(This information is provided by the company.)

CoreSite Realty Corporation is at the forefront of delivering secure, reliable, and high-performance data center solutions, cloud access, and interconnection services to a burgeoning customer base sprawled across eight prime North American markets. Over 1,375 top-tier enterprises, network operators, cloud providers, and supporting services opt for CoreSite to synchronize, safeguard, and optimize their performance-driven data, applications, and computational workloads. With a team of 460+ dedicated employees, their scalable and adaptable solutions offer a gamut of unparalleled data center options, ensuring a premier customer experience and fostering enduring relationships with clientele.

Fintel stands as a cornerstone investment research platform catering to individual investors, traders, financial advisors, and small hedge funds, offering a comprehensive array of data and insights that extend worldwide, comprising fundamental analysis, analyst reports, ownership data, fund and options sentiment, insider trading intel, options activity, unusual trades, and much more. Plus, their exclusive stock picks driven by sophisticated quantitative models promise improved profitability.

Unlock more insights by diving deeper into Fintel’s offerings.

This engaging narrative was originally featured on Fintel.

Remember, the opinions and stances articulated herein reflect the author’s personal viewpoints and may not necessarily align with those of Nasdaq, Inc.