NiSource reported fourth-quarter 2023 operating earnings per share (EPS) of 53 cents, exceeding the Zacks Consensus Estimate of 52 cents by 1.9%. The bottom line marked a 6% increase from the year-ago quarter’s figure of 50 cents. On a GAAP basis, the company reported an EPS of 50 cents compared with 52 cents in the prior-year quarter.

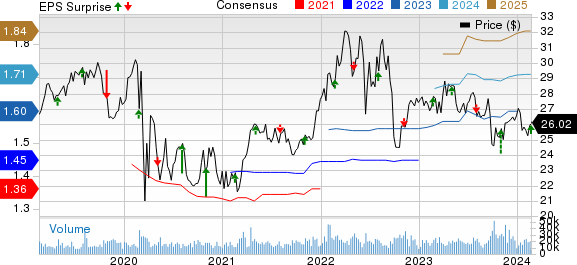

In 2023, NiSource reported earnings of $1.60 per share, compared with $1.47 per share in 2022, reflecting an 8.8% year-over-year increase.

Revenues Fall Short

Operating revenues of $1.42 billion missed the Zacks Consensus Estimate of $1.58 billion by 10.3%. The top line also decreased 3.4% from the prior-year quarter’s figure of $1.7 billion.

For the full year of 2023, NiSource reported total revenues of $5.5 billion, a decrease from $5.85 billion in 2022, which reflects a year-over-year decrease of 5.9%.

Key Highlights of the Release

Total operating expenses amounted to $1.06 billion, down 20.9% from the year-ago quarter, primarily due to lower energy costs. Operating income totaled $362.6 million, down 0.8% from the year-ago figure of $365.5 million. Net interest expenses amounted to $141 million, indicating an increase of 38.5% from the prior-year quarter’s $101.8 million. Additionally, total gas distribution in Sales and Transportation was recorded at 259.1 Million British Thermal Units per day (MMDth), down 3.6% from the prior-year quarter’s 268.7 MMDth. On the other hand, total electric sales were recorded at 3,604.6 gigawatt-hours (GWh), marking a 4.6% increase from the prior-year quarter’s 3,446.3 GWh.

Financial Update

NiSource’s cash and cash equivalents as of Dec 31, 2023 were $2.24 billion, a significant increase from $40.8 million as of Dec 31, 2022. Long-term debts (excluding those due within a year) as of Dec 31, 2023 were $11.05 billion compared with $9.5 billion as of Dec 31, 2022. Net cash flows from operating activities in 2023 were $1.93 billion compared with $1.41 billion in 2022.

Guidance and Ranking Update

The company raised its 2024 non-GAAP earnings to the band of $1.70-1.74 from the 1.68-1.72 band projected earlier. NiSource currently carries a Zacks Rank #2 (Buy). The company also expects to witness an earnings CAGR of 6-8% through 2028 and plans to invest $16 billion during the 2024-2028 period.

Upcoming Releases and Expert Analysis

Looking ahead, other companies like Pinnacle West (PNW), NRG Energy (NRG), and Vistra Energy Corp. (VST) are set to report their fourth-quarter 2023 results. While Pinnacle West is expected to show a year-over-year increase, NRG Energy and Vistra Energy Corp. are expected to undergo year-over-year declines based on the Zacks Consensus Estimates. The release presents investors with opportunities for further market analysis and potential investment prospects. Additionally, Zacks experts have identified 5 stocks with the potential to double in 2023.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.