Avangrid Inc.’s strategic long-term vision includes hefty capital expenditure plans aimed at elevating its infrastructure and enhancing its facilities. By expanding its capacity for clean energy generation, the company is poised to witness a significant boost in performance, offering investors a robust opportunity within the utility sector.

Let’s delve into the compelling factors that underscore why this current Zacks Rank #2 (Buy) entity makes its mark as a potent investment choice in the present landscape.

Growth on the Horizon

The Zacks Consensus Estimate pitches the 2024 earnings per share (EPS) at $2.25, depicting a promising 7.7% year-over-year surge. Additionally, the anticipated 2024 revenue estimate of $8.63 billion signifies a year-over-year uptick of 3.8%. With a long-term earnings growth rate of 3.63%, Avangrid is set on a trajectory towards sustainable expansion.

Financial Fortitude

Presently, Avangrid boasts a total debt to capital ratio of 33.88%, outshining the industry average of 62.21%. The company’s time-to-interest-earned ratio, standing at 2.6 as of the fourth quarter of 2023, reflects its robust capacity to meet future interest obligations without impediments.

Dividend Consistency

Avangrid has been steadily adding value for its shareholders through consistent dividend payouts. At present, the quarterly dividend stands at 44 cents per share, equating to an annualized dividend of $1.76. With a current dividend yield of 5.54% surpassing Zacks S&P 500 Composite’s 1.31%, Avangrid remains an attractive dividend play.

Strategic Investments & Environmental Commitment

In 2023, the company funneled nearly $3 billion into capital expenditures, marking an impressive 18% upsurge from the prior year. Avangrid, positioned as the third-largest U.S. onshore wind power generator, envisions attaining carbon neutrality by 2035. The initiation of the Vineyard Wind 1 offshore wind project in late 2023 highlights its commitment to clean energy. The colossal 806 megawatts (MW) offshore project is anticipated to cater to the energy needs of over 400,000 households and businesses in Massachusetts while significantly reducing carbon emissions annually.

Furthermore, Avangrid has made strides in renewables, boasting 8.6 GW of wind and solar capacity and signing substantial power purchase agreements. These developments aptly position Avangrid in the flourishing renewable energy domain.

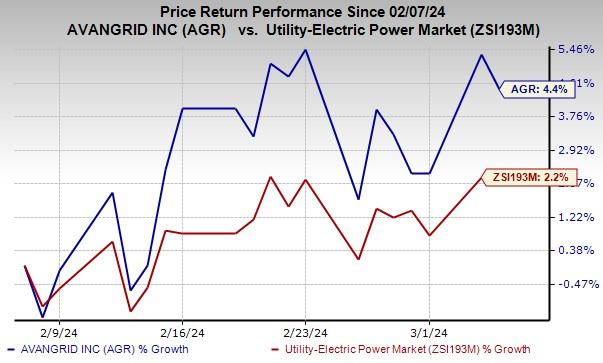

Performance in the Markets

Over the past month, Avangrid’s shares have witnessed a commendable 4.4% ascent, surpassing the industry growth of 2.2%. This positive performance underscores Avangrid’s resilience and potential for further growth in the market.

Stockscape to Explore

Alongside Avangrid, key players such as IDACORP (IDA), NiSource Inc. (NI), and DTE Energy (DTE) hold a Zacks Rank #2 currently. IDACORP boasts a long-term earnings growth rate of 4.38%, while NiSource Inc. and DTE Energy flaunt rates of 7.15% and 6%, respectively. These entities present compelling investment options within the utility sector.