The York Water Company YORW is a public utility company that’s made it their business to ensure folks have access to the clean water they need. It’s a Zacks Rank #2 (Buy) company with a whole lot going for it at the moment.

Growth Projections & Surprise History

YORW’s 2023 earnings per share (“EPS”) is expected to reach $1.59, as forecasted by Zacks, which is 3.9% on the uptick in the past 60 days. The 2024 EPS is projected at $1.61, seeing a 1.3% increase in the last 60 days.

As for sales, this year is estimated to hit $70 million, marking a 16.5% growth. For 2024, the forecast is pegged at $74 million, showcasing a 5.7% increase.

The company has a history of springing surprises, boasting an average earnings surprise of 6.72% over the past four quarters.

Long Dividend History

When it comes to dividends, The York Water has been consistently delivering. In November 2023, it declared a quarterly dividend of 21.08 cents per share, totaling 84.32 cents annually. This is a 4% increase from last year, and it marks the 612th consecutive dividend the company has paid to its shareholders.

Moreover, the folks at The York Water have been increasing their dividend for 27 long years. Currently, YORW’s dividend yield sits at 2.13%, edging out its industry’s 2.09% yield.

Return on Equity

If you’re after efficiency, know that YORW’s Return on Equity (ROE) is currently standing tall at 10.76%, surpassing the industry’s 9.32% average. That’s some mighty impressive fund utilization that’s getting more bang for its buck than its peers.

Debt Position

As of Sep 30, 2023, The York Water’s total debt-to-capital ratio came in at 43.5%, better than the industry average of 45.7%. Also, the times interest earned ratio at the end of the third quarter was comfortably sitting at 4.7, indicating the company’s ability to service its debts without any sweat.

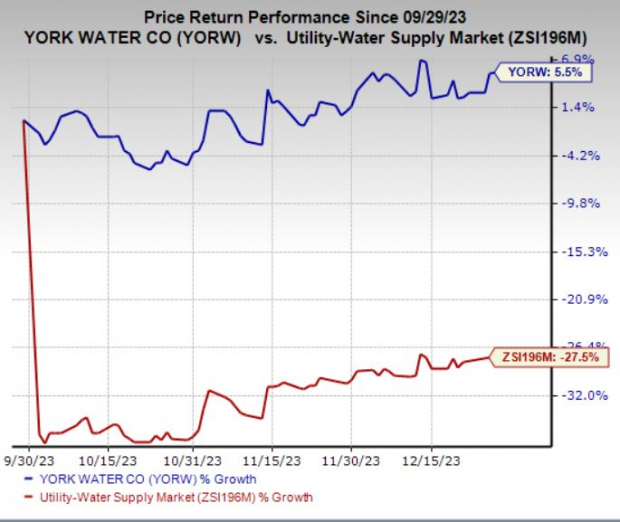

Price Performance

Over the last three months, YORW’s shares have gained 5.5%, distancing themselves from the broader industry’s 27.5% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

If you’re in the mood for more, check out other industry leaders like American Water Works AWK, SJW Group SJW, and Consolidated Water CWCO, each carrying a Zacks Rank of 2 at the moment.

American Water Works, SJW Group, and Consolidated Water have all produced some mouth-watering average earnings surprises – 6.5%, 20.05%, and 61.56%, respectively, over the past year. The consensus estimate for their EPS also reflects some juicy growth trends of 7.1%, 11.2%, and a whopping 224.1%, respectively.

Still not convinced? The Zacks Top 10 Stocks for 2024 could knock your socks off with their performance. Zacks’ Director of Research, Sheraz Mian, has been busy zeroing in on the best 10 stocks to buy and hold in 2024. If you want in, you better stay sharp and keep an eye out for these stocks when they’re unveiled on January 2. Don’t miss your chance to get in on the winners.

Be First to New Top 10 Stocks >>

Feeling like you want more recommendations from Zacks Investment Research? Well, lucky for you, you can grab the “7 Best Stocks for the Next 30 Days” report for absolutely zilch today. Now, isn’t that music to your ears?

Just a heads up – The views and opinions expressed are those of the author and don’t necessarily align with Nasdaq, Inc.