Taylor Morrison Home Corporation, TMHC, surpassed expectations in the fourth quarter of 2023, with both earnings and revenues surpassing the Zacks Consensus Estimate. Nevertheless, the housing firm witnessed a decline in both top and bottom-line figures compared to the previous year due to weakened housing demand related to higher mortgage rates during the period.

On February 14, 2024, the company’s stock climbed by 5.6% during the trading session, reflecting investor confidence in the firm’s performance.

Crunching the Numbers

Earnings per share came in at $2.05, beating the consensus mark of $1.76 by 16.5%. However, this was a 30% decrease from the prior-year quarter’s earnings of $2.93 per share. Meanwhile, total revenues, inclusive of Home closings, Land closings, Financial services, and other segments, amounted to $2.02 billion. This surpassed the consensus mark of $1.86 billion by 8.6%, yet marked a 19% decline from the prior year’s $2.49 billion

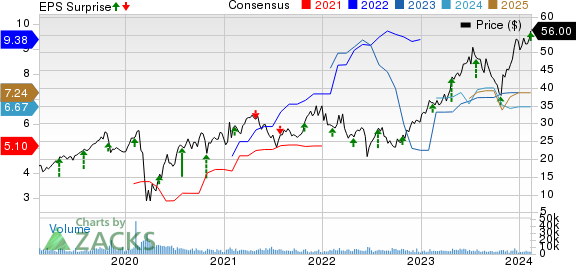

Taylor Morrison Home Corporation Price, Consensus, and EPS Surprise

Taylor Morrison Home Corporation price-consensus-eps-surprise-chart | Taylor Morrison Home Corporation Quote

The adjusted EBITDA for the quarter plummeted by 30.3% to $338.6 million from the previous year’s levels. Concurrently, the adjusted EBITDA margin contracted by 270 basis points (bps) to 16.8% compared to the previous year.

Delving into the Details

Home Closings: Revenues from home closings decreased by 18.5% year-over-year, amounting to $1.94 billion. This decline stemmed from a 16% reduction in home closings to 3,190 and a 3% decrease in the average closing price to $607,000 year-over-year.

Net sales orders registered a 30% upsurge, reaching 2,361 units from the previous year’s 1,810 units. This improvement resulted from a 29% increase in the monthly absorption pace to 2.4 per community and a 1% year-over-year rise in the ending community count to 327. The average net sales order price also increased by 9% year-over-year to $629,000.

Additionally, backlog at the end of December 31, 2023, showed an 11.2% decline from the prior year, amounting to 5,289 homes on a unit basis. The dollar basis declined by 10.3%, resting at $3.6 billion. The cancellation rate, as a percentage of gross orders, declined to 11.6% from 24.4% in the prior-year period.

Furthermore, the adjusted home closings gross margin contracted by 40 bps year-over-year to 24.1%. On the other hand, Selling, general, and administrative expenses (SG&A) as a percentage of home closings revenues increased by 240 bps from the previous year to 9.7%. This was attributed to lower home closings revenues, higher performance-based compensation expenses, and external broker commissions.

Financial Services: Revenues from this segment rose by 16.5% year-over-year, reaching $43.2 million. The mortgage capture rate for the quarter was 86%, higher than the 78% recorded a year ago.

Land Closings: The segment’s revenues surged by 104.8% year-over-year, totaling $29.5 million. Land acquisition and development spend in homebuilding during the quarter amounted to $537 million, marking a 44% increase from $373 million a year ago.

Amenity and Other: Revenues from this segment dropped by 84.8% year-over-year, amounting to $9.5 million.

Highlights of 2023

Total revenues for 2023 stood at $7.42 billion, reflecting a 9.8% decrease from the $8.22 billion reported in the prior year. Similarly, earnings were $7.54 per share, down from $9.35 per share reported in 2022. Total homes closings in 2023 amounted to 11,495 units, a 9.1% decrease from the 12,647 units in 2022.

Adjusted home closing gross margin for 2023 was 24%, down by 150 basis points from the 25.5% reported in 2022.

Financial Outlook

As of December 31, 2023, Taylor Morrison boasted total liquidity of approximately $1.8 billion, comprising $799 million in cash and cash equivalents and $1.1 billion of total capacity on the company’s revolving credit facilities. This was consistent with the company’s total liquidity at the end of 2022.

Throughout 2023, the company repurchased 2.8 million shares for $128 billion, leaving $494 million remaining on its share repurchase authorization at the end of December 2023. In addition, the net homebuilding debt-to-capital ratio was reduced to 16.8% from 24% a year prior.

Anticipating Q1 2024 and Beyond

For the first quarter of 2024, Taylor Morrison projects home closings of approximately 2,700 units, a slight increase from the 2,541 units in the previous year. The average home closing price is expected to be around $600,000, a decline from $635,000 a year ago. Simultaneously, the home sales gross margin is estimated to range from 23 to 23.5%, down from 23.9% in the prior-year quarter.

Looking ahead to 2024, the company anticipates home closings of approximately 12,000 units, compared to 11,495 units in the previous year. The average home closing price is expected to fall from $623,000 to around $600,000. The home closings gross margin is projected to be in the range of 23 to 23.5%, down from 23.9% in the prior year, while SG&A expenses are expected to be in the high-9% range, compared to 9.8% in the prior year.

Furthermore, land and development spending for 2024 is expected to range between $2.3 and $2.5 billion. The ending active community count is anticipated to be within 320-325, compared to 324 in the previous year. Finally, the effective tax rate is projected to be at 25% for the year.

Zacks Rank & Industry Peers

Taylor Morrison currently boasts a Zacks Rank #2 (Buy). Similarly, AECOM ACM and Martin Marietta Materials, Inc. MLM have reported strong performances recently.

The complete list of today’s Zacks #1 Rank (Strong Buy) stocks is available for reference. Meanwhile, AECOM anticipates robust organic net service revenues growth and improved adjusted EPS for fiscal 2024. On the other hand, Martin Marietta Materials, Inc. MLM reported mixed results in its recent release.

Q4 Earnings Report Reflects a Tale of Two Companies

Martin Marietta Materials, Inc. (MLM)

Emotions swirled as investors eagerly pored over Martin Marietta Materials, Inc.’s (MLM) fourth-quarter 2023 results. Earnings surged, beating the Zacks Consensus Estimate and standing tall on a year-over-year basis. Meanwhile, revenues missed the consensus mark but sprouted significantly compared to the previous year.

Looking ahead, MLM foresees robust demand for infrastructure, large-scale energy, and domestic manufacturing projects. This optimism stems from the company’s expectation that strong demand will offset any weakness in residential demand and the anticipated softening in light non-residential activity. With mortgage rates stabilizing and affordability headwinds tapering off, MLM predicts a recovery in single-family residential construction, especially in its key markets, propelled by persistent high demand.

Watsco, Inc. (WSO)

Conversely, Watsco, Inc. (WSO) painted a less rosy picture in its fourth-quarter 2023 earnings report. Both earnings and revenues slid below the Zacks Consensus Estimate. While the top line expanded year over year, the bottom line contracted.

The results mirrored a seasonal sales trend, indicating flat sales for HVAC equipment and a decline in sales for other HVAC products year over year. Additionally, sales volume for commercial refrigeration products dwindled. Compounding matters, soaring costs and expenses gnawed at the company’s bottom line, exacerbating its quarterly performance.

Zacks Names “Single Best Pick to Double”

Amidst these contrasting earnings reports, Zacks Investment Research has spotted a promising pick that might outshine recent stellar performers such as Boston Beer Company and NVIDIA. This selection is praised for its “watershed medical breakthrough” and is currently forging an impressive pipeline of projects designed to revolutionize the treatment of liver, lung, and blood-related diseases. Investors are urged to consider seizing this timely investment opportunity, particularly as the stock emerges from a downturn.

Such stock-picking prowess has fueled anticipation of another breakout akin to Boston Beer Company’s remarkable 143.0% surge in slightly over 9 months or NVIDIA’s staggering 175.9% leap in the span of a year.

Free: See Our Top Stock And 4 Runners Up

Watsco, Inc. (WSO) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.