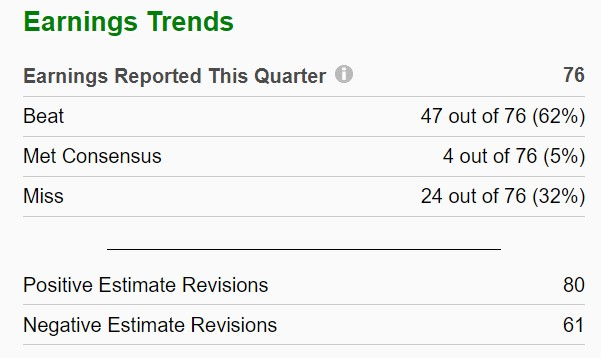

The retail earnings scorecard will be completed in the next few weeks with 62% of the companies in the Zacks Retail-Wholesale Sector beating earnings estimates so far.

Operating conditions appear to be strengthening amid easing inflation, setting the stage for favorable outcomes. As the earnings results from retail giants Lowe’s (LOW) and Target (TGT) are awaited, investors are poised for a closer look into potential market moves. Lowe’s results are due on Tuesday, February 27, followed by Target on Tuesday, March 5.

Image Source: Zacks Investment Research

Lowe’s Q4 Preview

Wall Street will closely monitor Lowe’s guidance in light of Home Depot’s results, which suggest a potential moderation in growth. Lowe’s is expected to indicate a slowdown, with projected earnings dropping by 26% to $1.68 per share compared to a strong quarter last year, highlighting a tough comparison.

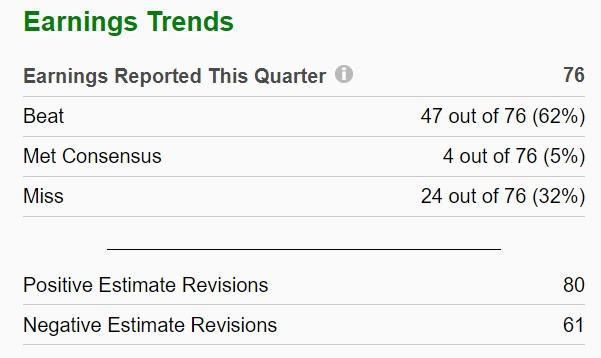

Image Source: Zacks Investment Research

Lowe’s valuation, with a trading multiple of 18.1X forward earnings, offers an attractive discount compared to Home Depot and its industry average. Despite trailing behind Home Depot in stock performance, Lowe’s has maintained a positive track record, consistently surpassing Zacks EPS Consensus estimates for 18 consecutive quarters.

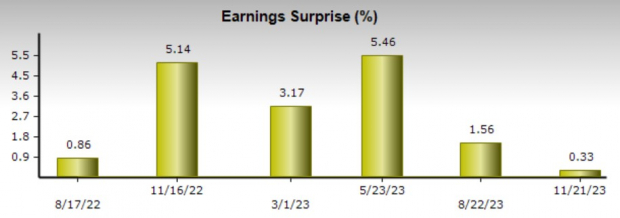

Image Source: Zacks Investment Research

Target Q4 Preview

While demand may be tapering for home improvement retailers post-pandemic, Target is poised for a strong rebound. The retailer has made substantial progress in addressing shrink issues and inflationary pressures, paving the way for a prospective return in demand for its premium products.

Image Source: Zacks Investment Research

Target’s Q4 earnings are expected to surge by 26% year-over-year to $2.38 per share, with sales anticipated to rise by over 1% to $31.88 billion. The retailer has consistently outperformed earnings estimates, showcasing a robust average earnings surprise of 30.84% over recent quarters.

Bottom Line

Comparatively, Lowe’s and Target present intriguing investment opportunities within the retail landscape. Target, with a Zacks Rank #2 (Buy), holds promise for upside potential, while Lowe’s garners a Zacks Rank #3 (Hold). These rankings illuminate the differing trajectories of the two companies as they navigate the ever-evolving market landscape.

7 Best Stocks for the Next 30 Days

Experts have identified 7 top stocks from a selection of Zacks Rank #1 Strong Buys, historically outperforming the market with a stellar average annual gain. These stocks are primed for potential price surges, making them a compelling choice for investors seeking optimal returns.

Read the full article on Zacks.com for additional insights.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.