Toll Brothers, Inc. reported solid results for first-quarter fiscal 2024, with an impressive performance that beat expectations and showcased growth on a year-over-year basis.

Shares of the leading luxury homebuilder rose during both the regular and after-hours trading sessions, signaling a positive market sentiment and investor confidence.

With a resurgent demand coinciding with the spring selling season, Toll Brothers depicts an optimistic outlook, supported by a robust job market, improved consumer confidence, and sustained low levels of resale inventory conducive to robust demand in the new homes market.

The company’s upward revision of its full-year guidance marks a strong start to the spring sales season, further bolstered by a significant land parcel sale, indicating a favorable fiscal second quarter.

Earnings & Revenue Discussion

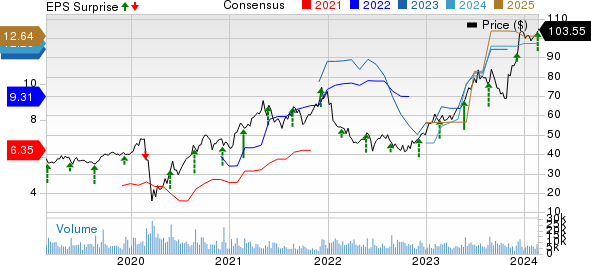

Toll Brothers delivered an EPS of $2.25, exceeding the Zacks Consensus Estimate and reflecting a remarkable 32.4% increase from the same period the previous year. This impressive increase was driven by higher revenues coupled with improved operational efficiency.

The company reported total revenues of $1.95 billion, surpassing the consensus mark and exhibiting a robust 9.4% year-over-year growth, primarily fueled by increased deliveries and prices.

Inside the Headlines

Total home sales revenues surged 10.4% from the prior-year quarter to reach $1.93 billion. Toll Brothers also witnessed a 40% year-over-year increase in net-signed contracts, reflecting a substantial rise in value at $2.06 billion.

The company’s backlog and potential revenues experienced a marginal decline, but Toll Brothers managed to curb its cancellation rate.

Margins

Toll Brothers achieved an expanded adjusted home sales gross margin of 28.9% and effectively reduced SG&A expenses as a percentage of home sales revenues, showcasing its commitment to operational excellence and cost discipline.

Financials

The company maintained a healthy financial position with a considerable amount of cash and available credit, along with a prudent management of its total debt.

Fiscal Second-Quarter Guidance

Toll Brothers projects a steady performance for the upcoming quarter, anticipating home deliveries at a slightly higher average price and period-end community count.

Fiscal 2024 Guidance Raised

Bolstered by its strong performance in the first quarter, Toll Brothers raised its guidance for fiscal 2024, indicating a solid growth trajectory in home deliveries and adjusted home sales gross margin, despite a marginal decrease in the average price of delivered homes from the previous year.

Zacks Rank

Toll Brothers currently carries a Zacks Rank #2 (Buy), further boosting investor confidence and underlining its potential in the market.

Peer Releases

In comparison to its peers, Toll Brothers stands out with its strong performance, fueling positive momentum and demonstrating its resilience in the market.