Fintel, a leading investing research platform, released a report on February 20, 2024, indicating that Truist Securities has downgraded their outlook for TreeHouse Foods (NYSE:THS) from a ‘Buy’ to a ‘Hold’.

Analyst Price Forecast Signals Potential Upside

Recent data reveals that the average one-year price target for TreeHouse Foods as of January 19, 2024, stands at 44.15. This insightful forecast ranges from a low of 38.38 to a high of $50.40 and suggests a considerable increase of 20.47% from its latest recorded closing price of 36.65.

Investors and analysts are closely monitoring the projected annual revenue for TreeHouse Foods, which is expected to reach 3,904MM, reflecting a substantial increase of 13.77%. Furthermore, the projected annual non-GAAP EPS is anticipated to be 3.07.

Fintel’s report sheds light on an altered sentiment towards TreeHouse Foods, with 580 funds or institutions reporting positions, indicating a decrease of 9 owners or 1.53% in the last quarter. The average portfolio weight of all funds dedicated to THS has diminished by 15.05%, currently standing at 0.26%. Additionally, total shares owned by institutions have decreased in the last three months by 8.24% to 65,777K shares.

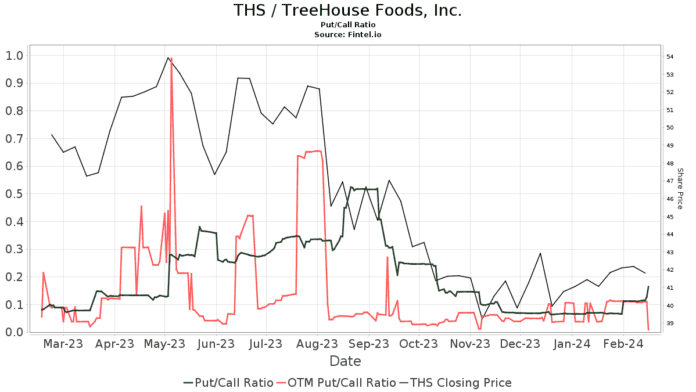

The put/call ratio of THS stands at 0.11, exemplifying a bullish outlook.

Significant shareholders have made noteworthy adjustments as well. T. Rowe Price Investment Management’s holdings of 6,276K shares represents 11.60% ownership of the company, with a decrease of 5.37% in its prior filing. Moreover, the firm has reduced its portfolio allocation in THS by 16.97% over the last quarter.

JANA Partners Management holds 4,908K shares, representing 9.07% ownership of the company, with no change in the last quarter.

IJR – iShares Core S&P Small-Cap ETF holds 3,465K shares, which accounts for 6.40% ownership of the company, with a decrease of 2.57% in its prior holdings, and a decreased portfolio allocation in THS by 12.51% over the last quarter.

RPMGX – T. Rowe Price Mid-Cap Growth Fund holds 2,740K shares, constituting 5.06% ownership of the company, with a decrease of 0.44% in its prior holdings and a lowered portfolio allocation in THS by 8.04% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 1,631K shares, representing 3.02% ownership of the company, with a decrease of 7.47% in its prior holdings and a reduced portfolio allocation in THS by 16.45% over the last quarter.

Insights into Treehouse Foods

TreeHouse Foods, Inc. is a leading manufacturer and distributor of private label packaged foods and beverages in North America, with nearly 40 production facilities across North America and Italy. The company’s extensive product portfolio spans snacking, beverages, and meal preparation products, available in various formats including shelf-stable, refrigerated, frozen, and fresh. Their offerings cover a wide range of packaging formats and flavor profiles, and include clean label, organic, and preservative-free ingredients across most of their portfolio. The company’s vision is to be the primary solutions leader for custom brands for its customers, aiming to make high-quality food and beverages affordable for all.

Fintel highlighted that it provides comprehensive research and investing data, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, Fintel’s exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

It’s important to remember that while the opinion and data shared in the report certainly provide significant insights, the views and opinions expressed are those of the author and do not necessarily reflect those of Nasdaq, Inc.

This article is a reaction to Fintel’s original report and does not necessarily reflect the views of Nasdaq, Inc.

>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.