Utility closed end funds have long been viewed as the ultimate fortresses of income and stability. Investors are drawn to the prospect of reaping the benefits of a stable sector and the allure of leverage. However, this seemingly idyllic picture is not immune to pitfalls, as evidenced by various articles examining the potential pitfalls of Utility CEFs. In this analysis, we compare two popular funds to guide potential investors through the labyrinth of decision-making.

The Comparison: Reaves Utility Income Trust Vs. Cohen & Steers Infrastructure Fund

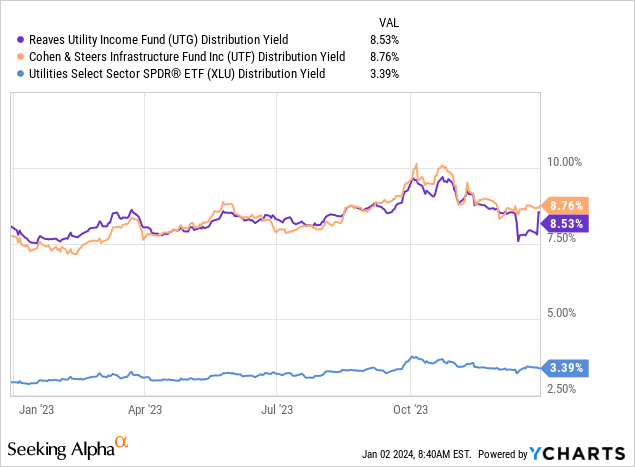

Reaves Utility Income Trust (NYSE:UTG) and Cohen & Steers Infrastructure Fund (NYSE:UTF) are formidable players in the world of closed-end funds, with market capitalizations of approximately $2 billion each. Notably, only about 15 funds boast a larger market capitalization within the expansive CEF Connect Database. Despite their divergent nomenclature, both funds gravitate heavily toward a single sector, with a predilection for utility-like companies such as telecoms and pipelines. Moreover, both bestow investors with remarkably generous yields, a feat unattainable when purchasing vanilla utility ETFs.

We begin by delving into three critical factors for investors to ponder before making their move.

Performance Analysis

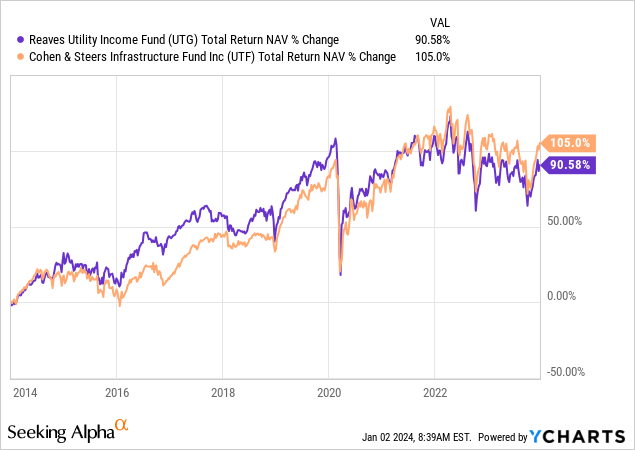

During the past decade, UTF has outperformed UTG on a NAV basis. The discrepancies in performance have been substantial, with fleeting periods of parity, and UTG even holding the lead during the onset of the COVID-19 crash.

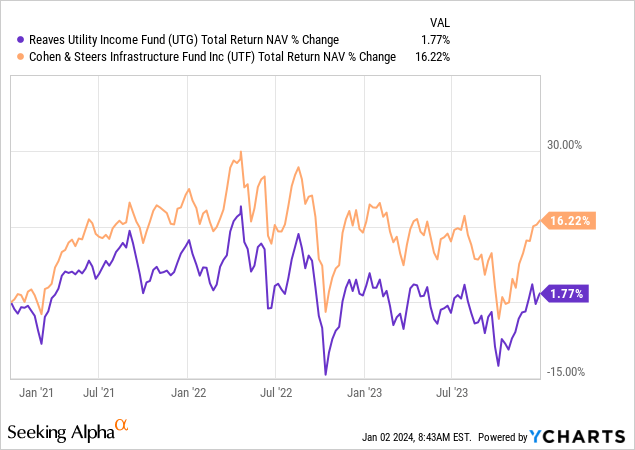

One intriguing aspect is the consistency of UTF’s performance over shorter timeframes. Here’s a comparison over the past 3 years.

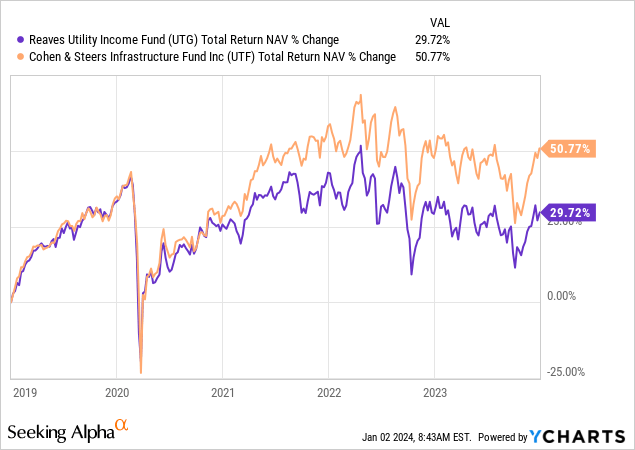

And here is the 5-year comparison.

All else being equal, the more consistent fund is typically preferred. In fact, many investors are willing to sacrifice some total performance for the sake of consistency. A fund with a lower beta tends to retain more adherents, even during the nadir of a bear market. Although we eschew the practice of chasing performance, UTF’s track record of consistent returns is undeniably impressive—a clear victory.

Leverage Examination

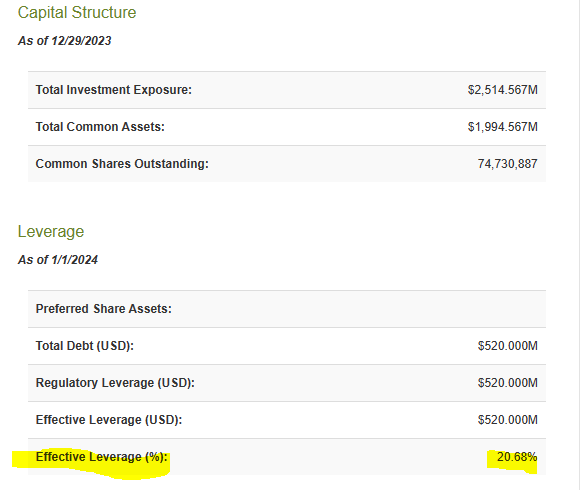

Leverage has been a predominant reason for our historical avoidance of CEFs’ common units, with one notable exception, in recent years. The notion of employing leverage—be it by us or through funds—has hardly sat well. It is worth noting that the underlying companies themselves have seemingly indulged in excessive leverage, spurred on by the near-zero interest rate policy, imbuing CFOs and CEOs with an illusory sense of invincibility. Regardless of the extremity of our stance, assessing leverage levels is paramount in comparing two funds. UTG emerges as the more judicious choice in this regard.

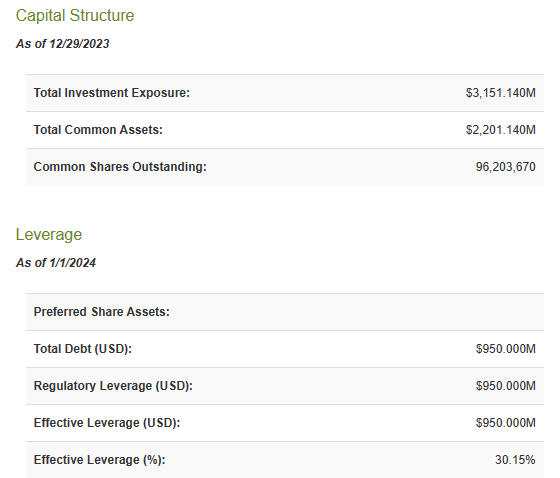

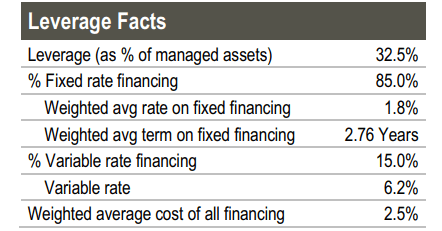

Conversely, UTF leans toward the higher end of the leverage spectrum.

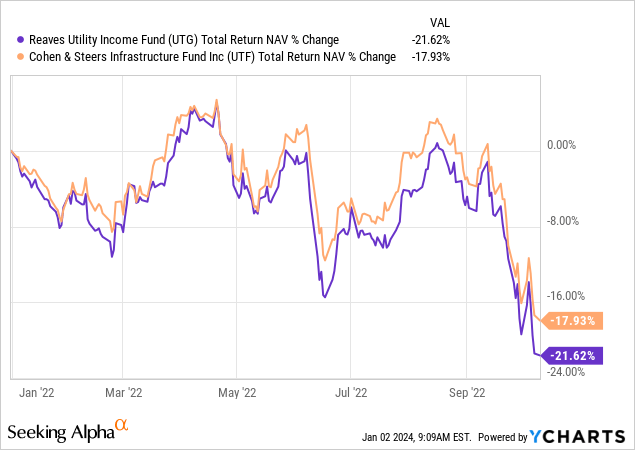

What captivates our attention is the fact that despite its amplified leverage, UTF has fared better on a NAV basis when scrutinizing peak drawdowns during the 2022 bear market.

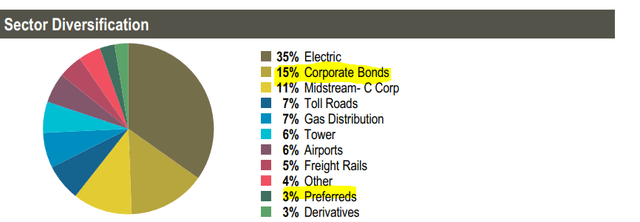

UTF has offset its heightened leverage by cultivating a diverse portfolio encompassing corporate bonds and preferred shares.

Furthermore, UTF boasts a marginally lower beta in its selection of investments, a facet that has worked to its advantage. Notably, UTF’s leverage costs are predominantly fixed-rate and presently come at minimal expense.

Conversely, UTG finds itself beleaguered by its interest rate payments relative to its peers.

For the year ended October 31, 2023, the average amount borrowed under the Credit Agreement was $517,643,836, at a weighted average rate of 5.42%. As of October 31, 2023, the amount of outstanding borrowings was $520,000,000, the interest rate was 5.99%, and the value of pledged collateral was $ $1,040,000,020.

Source: