VeriSign VRSN disclosed a significant uptick in domain name registrations, marking an 8.9 million increase year over year across all top-level domains (TLDs) in the fourth quarter of 2023, representing a 2.5% rise. Sequentially, domain name registrations saw a 0.2% uptick to reach 359.8 million.

Market Growth and Impediments

The company continues to reap the rewards of robust growth in .com and .net domain name registrations. Looking ahead to 2023, VeriSign projects the domain name base growth rate to either decline by 1% or ascend by 1% due to persisting uncertainty and weakness associated with China. The dampened demand from China-based registrars is attributable to economic uncertainty, stringent regulations, currency fluctuations, and retail pricing adjustments.

Notably, Q4 saw .com and .net TLDs together witness a 0.6% year-over-year decline equivalent to 1 million domain name registrations, with the total domain name bases for .com and .net amounting to 159.6 million and 13.1 million registrations, respectively, as of December 31, 2023.

Renewal Rates and Wholesale Price Adjustment

The company recorded 9 million new domain name registrations for .com and .net, in contrast to 9.7 million in the corresponding period of the previous year. Moreover, the final .com and .net renewal rates for the third quarter of 2023 stood at 73.5%, slightly down from 73.7% in the same quarter a year ago. VeriSign foresees the renewal rate for the fourth quarter of 2023 to hover around 73.1%, down from 73.3% in the year-ago quarter. The renewal rates are fully ascertainable 45 days after the end of the quarter.

In a bold move, VeriSign announced that it intends to elevate the annual registry-level wholesale price for .net domain names to $10.26 from $9.59, effective from September 1, 2024.

VeriSign’s Strategic Positioning

VeriSign, a leading provider of domain name registry services and Internet infrastructure, is steadfast in expanding its crucial infrastructure to cater to the burgeoning demand for DNS navigation services in various sectors including commerce, education, and healthcare.

Stock Performance and Recommendations

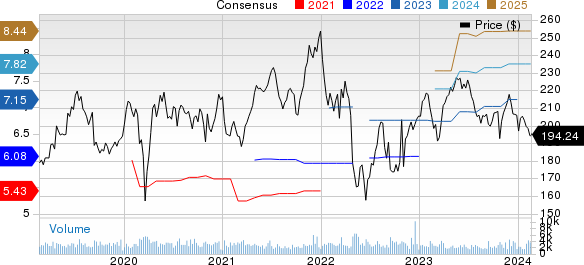

Despite the positive growth in domain name registrations, VRSN’s stock performance witnessed a decline of 5.1% over the past year, as opposed to the 17.5% growth in the sub-industry.

For investors seeking other potential investment avenues in the broader technology space, Cadence Design Systems, Inc. (CDNS), Woodward, Inc. (WWD), and Watts Water Technologies, Inc. (WTS) are worth considering. Cadence carries a Zacks Rank #1 (Strong Buy), while Watts Water Technologies and Woodward hold a Zacks Rank #2 (Buy).

Future Prospects

The Zacks Consensus Estimate for Cadence’s 2024 earnings per share (EPS) has surged 1.9% in the past 60 days to $5.87. Cadence has consistently surpassed the Zacks Consensus Estimate for earnings over the last four quarters, with a favorable average surprise percentage. Meanwhile, shares of CDNS have registered a robust 49.3% gain over the past year.

Woodward’s fiscal 2024 EPS estimate has witnessed a 5.7% increase over the past 60 days to $5.20 and the company has also delivered positive earnings surprises over the last four quarters, with an average surprise of 27.2%. Similarly, Watts Water Technologies saw an improvement in the Zacks Consensus Estimate for its fiscal 2024 EPS by 0.4% over the past 60 days to $8.35 and has consistently exceeded the Zacks Consensus Estimate for earnings, with an average surprise of 13.5% over the last four quarters, leading to a significant 11.9% surge in its shares over the past year.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful, outperforming the S&P 500 by a significant margin. Don’t miss out on the chance to discover these stocks with enormous potential.