Electric power companies have been riding a wave of success lately, buoyed by factors such as fresh electricity rates, customer growth, and cost controls. The unyielding push towards resiliency in the face of extreme weather and the shift towards affordable renewable energy sources are all adding fuel to the sector’s fire.

And despite the unpredictable whims of the weather, demand for utility services remains fairly steady, no matter what the economy may throw their way. In 2023, a minor hiccup came with a milder temperature in the early part of the year, reflecting a reduced usage. However, utilities are poised to reap the benefits of higher residential electricity rates.

What’s more, a palpable sea change has been shaking up the industry, with more and more companies laying down the gauntlet with zero-emission goals. Thanks to years of research and development, we’ve witnessed a marked drop in the cost of setting up large-scale renewable power projects, which in turn trims carbon emissions. The U.S. Energy Information Administration (EIA) forecasts a 3% dip in U.S. energy-related carbon emissions in 2023. A large part of this can be attributed to a reduced reliance on coal, with coal-related carbon emissions plummeting by 18% from 2022 levels. The EIA also estimates that renewable energy will hog an estimated 22% and 24% share of U.S. electricity generation in 2023 and 2024, respectively.

A head-to-head analysis has been conducted on two major Zacks Utility— Electric Power contenders — Vistra Corp. VST and IDACORP, Inc. IDA — to help investors determine the brighter star amidst the electric power rivalry.

As it stands, both these companies hold a Zacks Rank #2 (Buy) at present. The latest stock picks are waiting for you here.

At present, VST boasts a market capitalization of $13.5 billion, whereas IDACORP comes in at $4.96 billion.

Path to Prosperity

According to the Zacks Consensus Estimate, VST is anticipated to rake in earnings of $3.79 per share on revenues of $20.14 billion in 2023, marking a whopping 228.9% year-over-year jump in bottom-line performance and a brisk 46.7% uptick in top-line growth.

In contrast, the consensus mark for IDA’s 2023 earnings sits at $5.12 per share on revenues of $1.78 billion, translating to marginal 0.2% bottom-line growth and an 8.5% top-line surge.

Stock Showdown

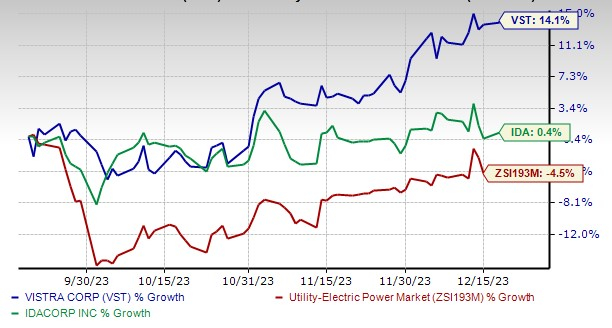

Over the past three months, VST shares surged by 14.1%, a stark contrast to the industry’s 4.5% loss. Meanwhile, IDA saw a modest 0.4% uptick during the same period.

Image Source: Zacks Investment Research

Ruling on Returns

When it comes to efficiency in leveraging shareholders’ funds, Vistra leads with a formidable 17.79% return on equity (ROE), towering over IDACORP’s more modest 9.51% showing. Both these figures paint a rosier picture than the industry’s 6.99% ROE.

Debt Dossier

The debt-to-capital ratio lays bare the financial fortitude of a company by showing how much of its operations are powered by debt. Vistra and IDACORP currently flaunt debt-to-capital ratios of 71.27% and 49.11%, respectively – both higher than the industry’s average of 61.19%.

Their times interest earned (TIE) ratios of 3.9 and 3.5, respectively, indicate both players have ample financial leeway to meet their imminent interest obligations.

Yielding Insights

Utility stocks are often celebrated for their generous dividend distributions. Presently, Vistra sports a 2.18% dividend yield, while IDACORP boasts a sturdier 3.39% yield. Both these figures put the Zacks S&P 500 Composite’s average dividend yield of 1.39% to shame.

VGM Check

The Zacks Style Scores offer investors a powerful tool for zeroing-in on the best stocks by evaluating their Value, Growth, and Momentum (VGM) score. In this arena, VST scores a D, while IDA holds a matching grade of D.

The Verdict

Both Vistra and IDACORP put up a commendable fight and stand as strong potential candidates for your investment portfolio. They’re primed to go up the ladder and meet the needs of their expanding customer base. But when pitted against each other, VST’s robust VGM score places it firmly ahead of IDA.

And hey, have you heard about ChatGPT’s “sleeper” stock? The world of Artificial Intelligence is set to explode to the tune of $15.7 Trillion by 2030, and Zacks is dishing out the inside scoop on this growth stock and 4 other “must buys.”

Get the ChatGPT Stock Report here

And if you’re craving the latest from Zacks Investment Research, they’ve got you covered with the 7 Best Stocks for the Next 30 Days.

Curious for a deeper dive? Check out IDACORP, Inc. (IDA) : Free Stock Analysis Report and Vistra Corp. (VST) : Free Stock Analysis Report.

For more, head over to Zacks.com to stay in the loop.

— The NASDAQ, Inc.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.