VICI Properties Inc. VICI, a New York-based experiential REIT, is set to release its fourth-quarter and full-year 2023 earnings results on Feb 22. Market analysts are expecting the company’s Q4 results to show a surge in revenues and funds from operations (FFO) per share.

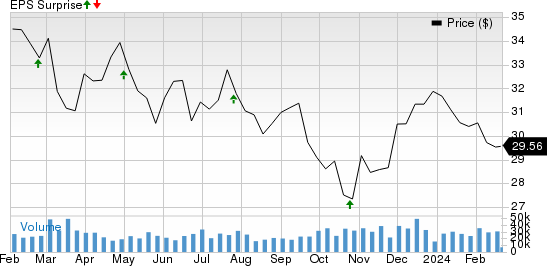

During the last reported quarter, VICI Properties outperformed market expectations, reporting an adjusted FFO per share of 54 cents, surpassing the Zacks Consensus Estimate by 1.89%. Over the previous four quarters, the company consistently exceeded the Zacks Consensus Estimate for FFO, with an average 1.93% beat.

Performance Recap

The company, which owns market-leading gaming, hospitality, and entertainment destinations, has shown resilience in its quarterly financial performance.

With ownership of iconic entertainment facilities like Caesars Palace Las Vegas, MGM Grand, and the Venetian Resort Las Vegas, VICI Properties owns a geographically diverse portfolio located in high barriers-to-entry markets across the United States and Canada.

The rebound in demand for its gaming facilities and other hospitality and entertainment destinations likely bolstered VICI Properties’ performance in the quarter. Healthy relationships with high-quality experiential operators and stable revenue generation through stable long-term leases are expected to have contributed to its top-line growth.

Moreover, VICI Properties continues its strategic expansion, venturing into the family entertainment sector through acquisitions, and expanding investments with existing partners.

Estimates and Future Outlook

The Zacks Consensus Estimate for quarterly revenues stands at $926.06 million, indicating a growth of 20.28% from the figure reported in the prior-year quarter. Moreover, expectations for growth in income from various segments further solidify the optimistic outlook.

While the Zacks Consensus Estimate for FFO per share remains unchanged at 55 cents over the past month, it indicates a robust 7.84% growth from the year-ago quarter.

For the full year, VICI Properties anticipates strong growth in Adjusted Funds from Operations (AFFO) and steady rise in revenues. The estimated AFFO for 2023 is in the range of $2,170 million to $2,180 million, translating to between $2.14 and $2.15 per share.

Analyst Insights

Despite strong fundamentals, our quantitative model does not conclusively predict a surprise in terms of FFO per share for VICI Properties this season. The company currently carries a Zacks Rank of 3 with an Earnings ESP of 0.00%.

Two other stocks in the broader REIT sector, Extra Space Storage Inc. and American Homes 4 Rent, are also projected to deliver favorable results this quarter, making them worth considering based on our model’s assessment.

Summary

Despite the positive outlook for VICI Properties, market analysts remain cautious on predicting a definitive FFO surprise. Investors are advised to keep a close watch on the upcoming earnings announcement, considering potential positive outcomes for Extra Space Storage Inc. and American Homes 4 Rent as well.

Note: The representations made in this article are based on funds from operations (FFO), which is a widely used metric for evaluating the performance of REITs.

Editor’s Note: Vicinity Properties is clearly headed for a showdown, and although experts remain skeptical about an earnings surprise, it’s clear that the company’s performance is worth monitoring closely. The looming quarterly results are getting the investment world all fidgety—let’s brace ourselves, ladies and gentlemen!

Looking for promising stocks to invest in? Our expert analysts have handpicked 5 stocks poised to double in 2023. Some of their previous recommendations have skyrocketed by more than 100%—don’t miss your chance to catch the next big winner.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

American Homes 4 Rent (AMH) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.