Host Hotels & Resorts, Inc. HST is all set to unveil its fourth-quarter and full-year 2023 earnings on Feb 21 post market closing. The probable headliner for investors is anticipated year-over-year revenue escalation, while funds from operations (FFO) per share is projected to hold steady.

During the previous quarter, the Maryland-based lodging real estate investment trust (REIT) outperformed expectations with a 17.14% surge in adjusted FFO per share, reflecting revenue beats.

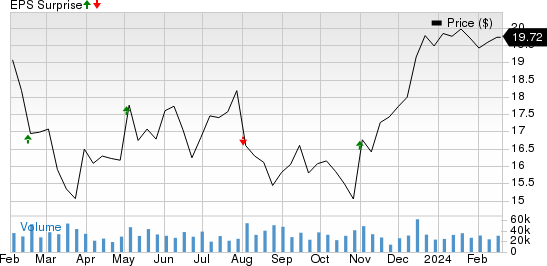

Over the past four quarters, Host Hotels surpassed adjusted FFO per share estimates thrice and missed once, with an average outperformance of 7.17%. See below for the detailed surprise history:

Balancing Act: Price and EPS Uncloaked

Host Hotels & Resorts, Inc. price-eps-surprise | Host Hotels & Resorts, Inc. Quote

Factors Driving the Narrative

Host Hotels boasts a lavish portfolio of upper-scale hotels spread across the top 20 promising U.S. markets, with a strong foothold in the alluring Sunbelt region. These properties are strategically nestled in the central business districts of major cities, in close proximity to airports and resort/conference hubs, bolstering consumer demand.

The resurgence in group and business transient demand, primarily driven by robust demand from small and medium-sized enterprises, has uplifted occupancy and hotel revenue per available room (RevPAR) in recent quarters. This momentum is expected to persist in the fourth quarter.

The Zacks Consensus Estimate for quarterly RevPAR stands at $200.41, indicating a 1.8% improvement from the year-ago period.

The consensus projection for average occupancy rate sits at 68.87%, reflecting an upturn from the previous year’s reported figure of 65.70%.

The Zacks Consensus Estimate for HST’s quarterly revenues currently stands at $1.30 billion, suggesting a 2.83% upswing from the prior year’s reported figure.

Host Hotels’ strategic capital allocations to enhance its portfolio’s quality and fortify its U.S. presence, where it enjoys a higher scale and competitive edge, are expected to have conferred an advantage, fostering margin expansion.

Nevertheless, we anticipate a shadow to be cast as leisure travel demand and rates at the company’s resorts could temper, alongside a slower-than-expected revival of group and business travel. Additionally, a decrease in inbound international travel may have raised concerns for Host Hotels.

Moreover, we envision a downer as higher interest expenses are likely to put a damper on fourth-quarter 2023 performance, expected to rise 9.2% year over year.

The company’s activities during the forthcoming quarter might not have sent ripples of reassurance among analysts. The Zacks Consensus Estimate for FFO per share remained unmoved at 44 cents over the past two months. Furthermore, this projection indicates no change from the year-ago figure.

For 2023, Host Hotels expects adjusted FFO per share in the $1.90-$1.95 range, based on the company’s forecast for comparable hotel RevPAR of $210-$213. The company envisions a 7.25-8.75% growth in comparable hotel RevPAR year over year, maintaining the midpoint at 8% despite the impact of Maui wildfires and lingering macroeconomic jitters.

For the full year, the Zacks Consensus Estimate for adjusted FFO per share stands at $1.92, reflecting a 7.26% surge from a 7.74% year-over-year revenue increase to $5.29 billion.

Prognostication with a Twist

Our reliable model doesn’t decisively project an FFO per share surprise for Host Hotels this season. The amalgamation of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) enhances the likelihood of an FFO beat, an alignment absent in this case.

Host Hotels currently holds a Zacks Rank of 3 and an Earnings ESP of -5.25%. You can capitalize on the best stocks before their release by checking out our Earnings ESP Filter.

Compelling Alternatives

Consider casting your gaze in the broader REIT arena on Extra Space Storage Inc. EXR and American Homes 4 Rent AMH, as our model anticipates a surprise in their upcoming quarterly showings.

Extra Space Storage, slated to table its quarterly numbers on Feb 27, boasts an Earnings ESP of +1.08% and holds a Zacks Rank of 3. You can access the full list of today’s Zacks #1 Rank stocks here.

American Homes 4 Rent, set to disclose quarterly figures on Feb 22, sports an Earnings ESP of +1.68% and currently carries a Zacks Rank of 3.

Keep yourself informed of upcoming earnings announcements using the Zacks Earnings Calendar.

Note: Any earnings-related details featured in this article pertain to funds from operations (FFO) — a widely-used metric for assessing REIT performance.

Access the full article on Zacks.com here.

The thoughts and perspectives expressed herein represent those of the author and not necessarily those of Nasdaq, Inc.