Industry Overview

Companies in the Zacks Oil and Gas – US E&P industry focus on the exploration and production of oil and natural gas within the domestic market. These firms delve deep to uncover hydrocarbon reservoirs, drill wells, and deliver raw materials for future refinement into various petroleum products. With the sector’s profitability intricately tied to the whims of supply and demand of fossil fuels, the volatility in energy market prices can significantly impact the cash flow of these operators.

Insight into the Oil and Gas – US E&P Industry

Fed’s Hawkish Stance, High Production Roil Oil, Gas: Recent pressure on WTI crude, the U.S. benchmark, comes on the heels of the Federal Reserve’s hawkish stance and steady crude production rates hovering near record highs. The concerns about interest rate hikes dampening energy demand, coupled with surplus crude stocks and low refinery activities, have hindered any price surge. Not to mention, natural gas prices plummeting due to increased production levels and lukewarm weather-driven demand exacerbating the woes.

Focused on Cost-Cutting Initiatives: Responding to market dynamics, energy firms have tightened their belts, slashing costs, and seeking innovative ways to boost output efficiency. By improving drilling methods and negotiating favorable contracts with service providers, these companies have managed to adapt to the challenging landscape. The pandemic-induced crude price collapse nudged them towards more judicious capital spending, preserving cash flow, and fortifying their balance sheets.

Concerns About Supply-Chain Tightness: Rising costs and supply-chain bottlenecks have plagued energy companies, impacting their bottom line. Inflation, though moderating, remains a challenge, thwarting capital programs and nullifying any gains from price hikes. Such enduring inflationary pressures are expected to persist, casting a shadow on growth and margins, especially for oil and gas exploration and production equities.

Market Position and Valuations

The Zacks Oil and Gas – US E&P industry currently stands at a Zacks Industry Rank of #240, placing it among the bottom 4% of Zacks industries. This ranking signals a bearish outlook fueled by analysts’ dimmed earnings growth projections for 2024, representing a 39.5% decrease from the previous year. Despite these challenges, there are still opportunities for savvy investors to capitalize on potential growth in the industry.

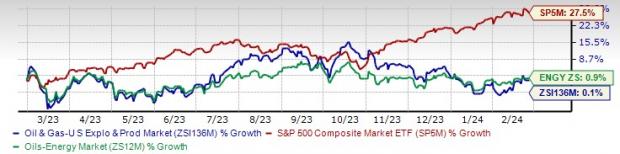

Reflecting on past performance, the industry has lagged behind the S&P 500 and the broader Oil – Energy sector over the past year, with subdued gains compared to the significant upticks seen in other segments. Valuation-wise, the industry’s EV/EBITDA ratio stands at 7.03X, marking a discount from the S&P 500 while holding ground above the sector’s average. With a historical trading range between 3.57X and 12.49X over the last five years, investors need to carefully weigh risk and reward in their investment decisions.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio (Past Five Years)

Thriving Through the Rough Waters: Top Picks in the Energy Sector

Shining Stars in Energy Stocks Universe

Diamondback Energy, Coterra Energy, APA Corporation, and Magnolia Oil & Gas have been making waves in the energy sector, each with its unique set of strengths and prospects for investors.

Diamondback Energy: Powering Ahead in the Permian Basin

Diamondback Energy’s success story in the Permian Basin is akin to a ship sailing smoothly through stormy seas. The company’s strategic focus on acquisitions and active drilling has propelled it to the forefront of the industry. With robust operational and financial performance, backed by a strong production profile and low breakeven economics, Diamondback Energy stands out among its peers.

Coterra Energy’s prowess lies in its diverse portfolio across multiple basins, boasting top-tier assets and minimal breakeven costs. The company’s prudent financial management, coupled with a focus on returning value to shareholders, makes it a compelling choice for investors seeking long-term growth.

APA Corporation: Unleashing Potential in Diverse Reserves

APA Corporation’s strategic focus on geographically diversified reserves and high-quality drilling inventory sets the stage for sustained production growth. The company’s foray into the Permian basin and offshore Suriname further adds to its growth trajectory. Despite recent stock performance challenges, APA Corporation’s strong fundamentals signal resilience in the face of market fluctuations.

Magnolia Oil & Gas: Sailing Smoothly with Unit Metrics

Magnolia Oil & Gas’ success can be likened to a well-oiled machine, with a pronounced emphasis on enhancing unit metrics and operational efficiency. The company’s commitment to growth through active drilling and smart acquisitions has yielded positive results, positioning it as a solid contender in the competitive energy landscape.

Seizing Opportunities in the Semiconductor Arena

The semiconductor industry, a bustling hub of innovation and growth, presents a myriad of opportunities for investors looking to capitalize on the burgeoning demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. With global semiconductor manufacturing projected to soar in the coming years, now is the time to explore potential investment avenues in this dynamic sector.

Discover the Top Semiconductor Stock Now

Gain Insights with Zacks Investment Research

Read More Insights on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.