Insiders in company structures – including officers, directors, or significant stockholders – move within a realm that offers intriguing hints about long-term strategies. Their transactions, laden with confidentiality and restricted by stringent regulations, present a unique tapestry of information for the discerning investor.

Within this milieu, let’s delve into recent insider activity at three prominent entities – Starbucks (SBUX), Casey’s General Stores (CASY), and Dollar General (DG), showcasing pivotal transactions that may influence market decisions.

Starbucks: A Shot in the Arm

Amidst turbulent waters, a director at Starbucks made ripples by snapping up 380 SBUX shares, amounting to nearly $35k. The company, grappling with challenges in China, witnessed a downturn in crucial metrics. However, optimism surged after news broke of Chipotle Mexican Grill CEO Brian Niccol stepping into the CEO role, hinting at potential growth on the horizon.

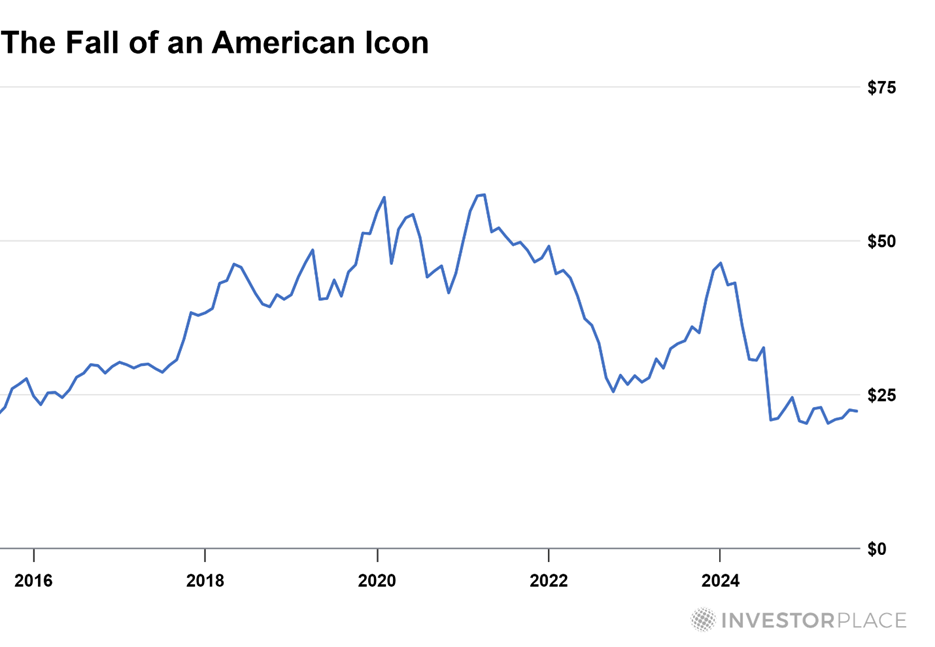

Dollar General: A Cautionary Tale

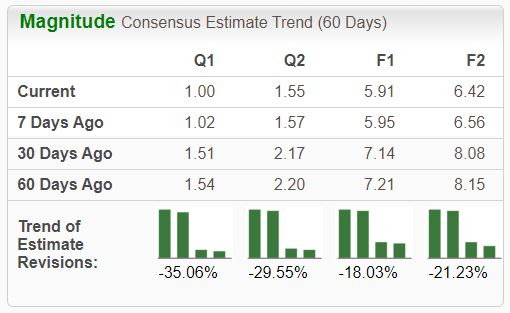

Against a backdrop of gloomy earnings prospects, a DG director acquired 1k shares worth just over $80k, prompting investors to exercise prudence due to the unfavorable Zacks Rank #5 (Strong Sell) the stock currently carries. Vigilant investors await positive earnings revision signals before considering short-term price movements.

Casey’s General Stores: Heating Up

In a show of confidence, a director at CASY purchased approximately 270 shares in late September, amplifying their stake by around $100k. While the stock has dazzled in recent times with robust financial reports, a recent period of consolidation beckons attention, with overall gains sitting handsomely at 84%.

Zacks Identifies Top Semiconductor Stock

Venture into a semiconductor darling, a mere fraction of giant NVIDIA’s size but poised for massive growth. NVIDIA’s behemoth strides left jaws agape with an 800% surge post-recommendation. Now, this chip contender, thriving on earnings growth and a burgeoning client base, stands ready to cater to the voracious appetite for Artificial Intelligence, Machine Learning, and Internet of Things. Rev up for the semiconductor industry’s meteoric rise from $452 billion in 2021 to a projected $803 billion by 2028.

Spot This Stock for Free Now >>

Keen for the Latest Picks from Zacks Investment Research? Download 5 Stocks Poised to Double Today

Discover More:

Unveil the Free Stock Analysis Report for Dollar General Corporation (DG)

Check Out the Free Stock Analysis Report for Starbucks Corporation (SBUX)

Explore the Free Stock Analysis Report for Casey’s General Stores, Inc. (CASY)

Read the full article on Zacks.com here

The perspectives shared here belong to the writer and do not necessarily mirror those of Nasdaq, Inc.