Uniform and facility services conglomerate, Cintas Corporation, has recently completed the acquisition of SITEX, a renowned provider of uniform and facility service solutions. The financial details of the buyout have not been disclosed.

Cintas’ stock remained relatively steady, closing at $614.64 during the most recent trading session.

SITEX, located in Henderson, KY, operates as a leading apparel and facility services provider in the four-state region encompassing Illinois, Indiana, Tennessee, and Kentucky. The company has established a strong reputation for providing a wide range of products and services, including uniform and apparel, chef apparel, linens, aprons, mats, restroom and hygiene services, facilities services, custom apparel, and promotional products.

Strategic Acquisition

For Cintas, this recent acquisition aligns with the company’s ongoing strategy to enhance its business and product portfolio. By integrating SITEX’s diverse range of apparel and other offerings, supported by its strong customer service capabilities, Cintas will be well-positioned to expand its product range. This move is expected to further solidify Cintas’ leading market position in the central Midwest region of the United States.

Zacks Rank & Price Performance

With a market capitalization of $62.3 billion, Cintas currently holds a Zacks Rank #2 (Buy). The company’s Uniform Rental and Facility Services business is benefiting from robust demand in the healthcare, education, and government sectors. Additionally, the growth of the First Aid and Safety Services segment is being driven by higher customer retention levels. Cintas’ focus on enhancing its product portfolio holds significant promise.

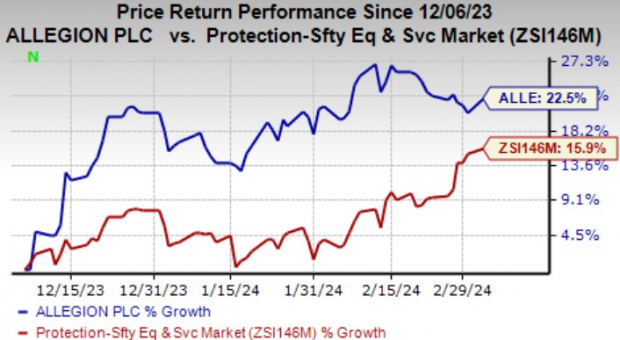

Image Source: Zacks Investment Research

The company’s stock has exhibited a 26.5% increase, outperforming the industry’s growth of 24.9% over the past six months. The Zacks Consensus Estimate for CTAS’ fiscal 2024 earnings has also witnessed a 0.3% improvement in the last 60 days, with a trailing four-quarter average earnings surprise of 3.5%.

Other Top Picks

Additionally, three other top-ranked stocks from the Industrial Products sector include Applied Industrial Technologies (AIT), Parker-Hannifin Corporation (PH), and Tetra Tech Inc. (TTEK), all of which carry a Zacks Rank #2. Notably, AIT, PH, and TTEK have delivered impressive average earnings surprises over the past four quarters, with their 2024 earnings estimates displaying positive momentum in the last 60 days.

For investors, these developments indicate that Cintas Corporation, through its strategic acquisition, is well-positioned to elevate its standing in the central Midwest region, and potentially boost its bottom line. Coupled with its favorable Zacks Rank and price performance, Cintas appears to be a promising prospect in the current market climate.