The Unseen Potential

As the bustling earnings season approaches, it’s easy for investors to miss the under-the-radar stocks that are poised to surprise the market. The week’s lineup features several such top-rated Zacks stocks that have the potential to outperform on Thursday, January 25.

Concrete Gains with Eagle Materials

Eagle Materials (EXP), the provider of concrete and cement, has quietly been reaping the rewards of the thriving Zacks Construction sector, ranked second out of 16 Zacks sectors. Notably, its Zacks Building Products-Concrete and Aggregates Industry is currently in the top 16% of over 250 Zacks industries.

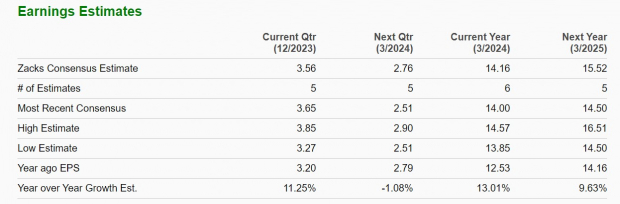

The company’s fiscal third-quarter earnings are expected to soar by 11% year over year to $3.56 per share, with sales projected to rise by 5% to $537.23 million. With a stock that has surged by +47% in the last year and still trades at an appealing 14.8X forward earnings multiple, Eagle Materials holds promise. The annual EPS forecast signals an impressive 13% leap in fiscal 2024 and an additional 9% climb in FY25 to $15.52 per share. Additionally, the company has surpassed earnings expectations in three of its last four quarterly reports, showing an average earnings surprise of 5.35%.

Popular – More Than Just a Name

Popular is another intriguing contender, demonstrating the strength of regional banks in the earnings season. With its Zacks Banks-Southeast Industry currently ranked in the top 28% of all Zacks industries, Popular is not to be overlooked. As one of the largest retail franchises in Puerto Rico, Banco Popular de Puerto Rico has a solid presence, and the bank also has branches in New York, the U.S. Virgin Islands, and the British Virgin Islands.

Despite Q4 earnings being projected at $1.05 per share, in contrast to $3.56 per share in the prior-year quarter, Popular’s valuation is particularly compelling. Even after a remarkable fiscal 2022, Popular is anticipated to conclude FY23 with EPS declining by -50% to $7.27 per share. However, with the stock trading at just 9.7X forward earnings, there is optimism. Furthermore, Popular’s stock has gained a noteworthy +19% in the last year, and the company has surpassed earnings expectations in each of its last four quarterly reports, with an average earnings surprise of 15.40%.

The Ones to Watch

In addition to Eagle Materials and Popular, two more top-rated Zacks stocks are worth monitoring in Thursday’s earnings lineup, namely Volvo (VLVLY) and Western Digital (WDC).

Volvo, with its stock climbing by +16% over the last year, presents an attractive valuation at 11.2X forward earnings, especially as annual EPS estimates have seen positive growth for both FY23 and FY24. Meanwhile, Western Digital, amidst a +30% rally in the last year, is expected to regain its earnings potential and profitability in 2024, as inflation eases.

Popular, Inc. (BPOP) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.