RLI Corp. RLI has been gaining momentum on the back of a compelling product portfolio, rate increases, improved retention, higher premium receipts, and sufficient liquidity.

Positive Growth Predictions

The Zacks Consensus Estimate for 2024 and 2025 earnings per share is pegged at $5.54 and $5.82, indicating an increase of 12.1% and 4.9% from the year-ago reported figure, driven by 15.3% and 9.1% higher revenues of $1.63 billion and $1.78 billion, respectively.

Estimate Revision

The Zacks Consensus Estimate for 2024 and 2025 has moved 0.5% and 1.04% north, respectively, in the past seven days. This should instill investors’ confidence in the stock.

Earnings Track Record

RLI has a solid track record of beating earnings estimates in three of the last four quarters while missing in one, the average being 137.08%.

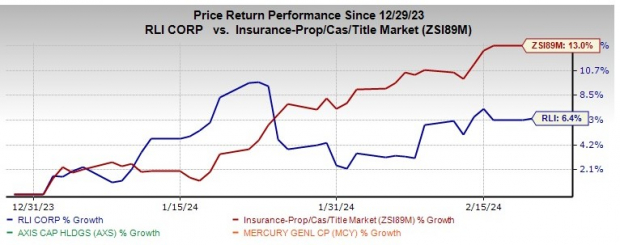

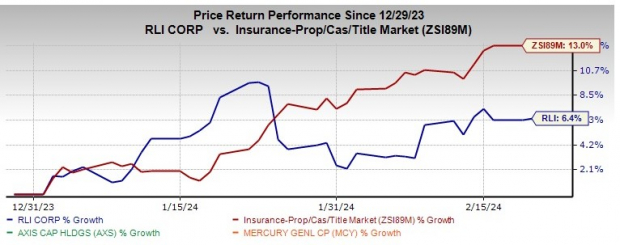

Zacks Rank & Price Performance

The company currently carries a Zacks Rank #3 (Hold). Year to date, the stock has gained 6.4% compared with the industry’s growth of 13%.

Image Source: Zacks Investment Research

Business Tailwinds

RLI has witnessed growth and financial success across its Casualty, Property, and Surety segments due to product diversification. The company’s solid operating results and financial position remain strong.

Moreover, RLI has been paying dividends for 187 consecutive quarters and increased regular dividends in each of the last 48 years, boasting an eight-year CAGR of 3.9%. Its dividend yield of 0.7% is better than the industry average of 0.2%, making the stock an attractive pick for yield-seeking investors.

Furthermore, the insurer has also been paying special dividends since 2011. The recent approval of $2 in special dividend in November 2023 marks the 14th straight special dividend. The company has $87.5 million of remaining capacity from the repurchase program.

Stocks to Consider

Some better-ranked stocks from the property and casualty insurance industry are Axis Capital Holdings Limited AXS, Mercury General Corporation MCY, and Arch Capital Group Ltd. ACGL. While Axis Capital and Mercury General sport a Zacks Rank #1 (Strong Buy) each, Arch Capital carries a Zacks Rank #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank stockshere.

Axis Capital has a solid record of beating earnings estimates in each of the trailing four quarters, the average being 102.57%. Year to date, the insurer has gained 11.5%.

Mercury General beat estimates in three of the last four quarters and matched in one, the average being 3,417.48%. Year to date, the insurer has rallied 36.1%.

Arch Capital has a solid record of beating earnings estimates in each of the trailing four quarters, the average being 27.32%. Year to date, ACGL has jumped 14.9%.

Additionally, hindsight reveals the upward trajectory of stocks handpicked by Zacks’s best like rotund rockets, with the previous recommendations having soared +143.0%, +175.9%, +498.3%, and +673.0%. Notably, the stocks in this report offer a chance to get in at the ground floor.

Want to see these potential home runs? Click here!

For a free stock analysis report of RLI Corp, click here.

To access the free stock analysis report of Axis Capital Holdings Limited, click here.

For a free stock analysis report of Arch Capital Group Ltd., click here.

To access the free stock analysis report of Mercury General Corporation, click here.

Click here to read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.