Life at L.B. Foster Company (FSTR) saw a wave of mixed fortune in the fourth quarter of 2023. The company reported a loss of 4 cents per share, a notable improvement from the $4.09 per share loss in the same period a year ago. However, this figure fell slightly short of the Zacks Consensus Estimate, scraping in at a loss of 3 cents.

Despite the tides of fate, hope lingered as revenues for the quarter stood firm at $134.9 million, showcasing a modest 2% downtick from the previous year. Yet, the figures surpassed the Zacks Consensus Estimate of $127.7 million, painting a picture of resilience in turbulent waters. The company experienced a growth of 7.7% in net sales organically, somewhat offset by a 9.4% decrease due to divestitures.

Riding the Currents: Segment Performances

In the realm of segments, the Rail, Technologies, and Services sector faced choppy waters, witnessing a decline of approximately 11% year over year in sales, totaling $69.3 million. The divestment of the prestressed concrete railroad tie business caused this dip, with organic sales also slipping by 4%.

On the brighter side, the Infrastructure Solutions segment surged ahead with sales reaching $65.6 million, marking a 10% increase from the previous year. The growth was primarily fueled by the Precast Concrete Products and Steel Products business units, with organic sales spiking by an impressive 23.1%.

Setting Sail: Looking Back at FY23

Reflecting on the full year of 2023, earnings closed at 13 cents per share, a remarkable turnaround from the $4.25 per share loss recorded the year prior. Net sales for the year surged by approximately 9% year over year, reaching $543.7 million.

Charting the Course: Financial Insights

As the fiscal year drew to a close, L.B. Foster found itself with around $2.6 million in cash and cash equivalents, a modest 11% decrease from the previous year. Long-term debt, on the other hand, dwindled impressively by about 40% year over year to approximately $55.2 million.

The company navigated its financial waters adeptly, with cash provided by operating activities amounting to $37.4 million in 2023, culminating in a free cash flow of $33 million.

Charting the New Horizons: Outlook and Performance

Casting the gaze forward, FSTR foresees adjusted EBITDA landing between $34-$39 million for 2024. Net sales are projected to traverse the band of $525-$560 million for the year, ushering in a phase of potential growth and expansion.

Furthermore, the company anticipates free cash flow for the upcoming year to sway within the $12-$18 million range, setting the stage for a journey towards financial stability and prosperity.

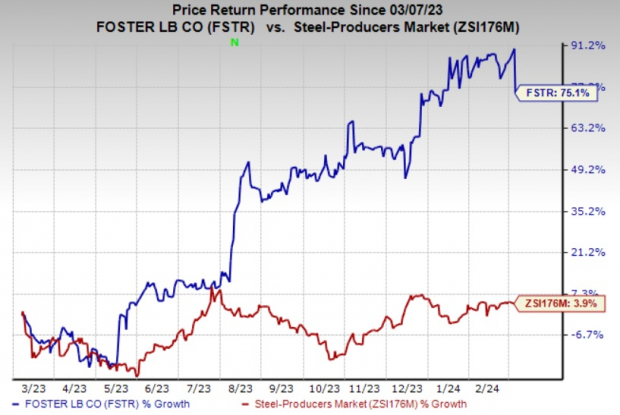

Sailing Ahead: Price Performance and Industry Comparison

In the realm of price performance, L.B. Foster’s shares have charted an impressive course, rallying by a substantial 75.1% over the past year, outpacing the steel producers industry’s 3.9% uptick.

Image Source: Zacks Investment Research

Spotlight on Excellence: Zacks Rank & Key Picks

FSTR currently adorns a Zacks Rank #3 (Hold). Delving deeper into the realm of promising stocks within the basic materials sphere, stars like Alpha Metallurgical Resources Inc. (AMR), Carpenter Technology Corporation (CRS), and Hawkins, Inc. (HWKN) shine bright.

These stocks exhibit promising futures, with Alpha Metallurgical Resources displaying a robust upward trend in earnings estimates and a Zacks Rank #1 (Strong Buy). Meanwhile, Carpenter Technology Corporation and Hawkins, Inc. also boast strong performances and optimistic outlooks, showcasing steady growth and investor appeal within the market.

Exploring new possibilities and embarking on fresh adventures, the path ahead holds promise and potential for those willing to navigate the financial waters with care and foresight.