Lockheed’s foray into the defense sector just got a hefty boost. The aerospace giant’s Space Systems arm has secured a lucrative deal for its Trident II (D5) Missile. This prestigious contract comes courtesy of the Strategic Systems Programs in Washington, D.C.

Ins and Outs of the Agreement

The contract, valued at a hefty $109.2 million, is set to wrap up by Feb 28, 2029. In line with the deal’s stipulations, Lockheed will play a pivotal role in integrating the Trident II (D5) Missile and its reentry subsystems into the Common Missile Compartment. These components are intended for the U.S./U.K. Columbia/Dreadnought submarine construction initiatives.

Most of the heavy lifting for this contract will be carried out in the hallowed grounds of Cape Canaveral, FL.

Why Lockheed is in the Winner’s Circle

Lockheed’s Trident II D5 fleet ballistic missile represents the pinnacle of the U.S. Navy’s submarine-launched arsenal. This cutting-edge missile lineage follows in the footsteps of the acclaimed Polaris, Poseidon, and Trident I C4 programs. Notably, the Trident II (D5) is currently the sole submarine-launched intercontinental ballistic missile being produced in the United States, underlining its critical role in the nation’s maritime defense.

The Space Systems unit at Lockheed stands as the primary contractor responsible for the development, production, and support equipment of this formidable missile. Additionally, the company extends technical and logistical support at deployment sites for the missile.

With its exceptional capabilities tailored for diverse military missions, Lockheed is consistently winning lucrative contracts for the Trident missile. The latest triumph is a testament to this fact. This achievement is poised to bolster the revenues of LMT’s Space Systems unit, which recorded a solid 3.5% year-over-year growth in the final quarter of 2023.

Charting the Growth Trajectory

Recent years have witnessed a surge in military expenditure as nations ramp up their defense infrastructure in response to escalating geopolitical tensions. In this milieu, the demand for missiles is expected to surge, given their pivotal role in military operations.

According to the latest insights from Mordor Intelligence, the global missile and missile defense systems market is slated to achieve a commendable CAGR of 4.8% during the 2024-2029 period. Such projections present a vast playing field for Lockheed to harness as the market continues to expand.

The Space Systems unit at Lockheed, in addition to spearheading satellites and space transport systems, is also involved in producing strike missiles and missile defense systems. Besides the Trident II missile, the unit oversees the Next Generation Interceptor program in collaboration with the Missile Defense Agency. Boasting cutting-edge propulsion and sensor technologies, this program aims to fortify homeland missile defense. Another notable project under its purview is the Next Generation Overhead Persistent Infrared (Next Gen OPIR) system, which bolsters the U.S. Space Force with advanced global missile warning capabilities.

Promising Avenues for Peers

Apart from Lockheed, other prominent players in the defense domain are poised to reap the benefits of the expanding missile defense market. Companies like Northrop Grumman, General Dynamics, and RTX Corp. are actively engaged in missile manufacturing or offering support services for the same.

Northrop Grumman’s Missile Products arm is a leading provider of solid rocket propulsion for national security and defense in the U.S. The company supplies stages for various weapon systems, including air-launched missiles, interceptors, submarine-launched systems, and hypersonic missile systems.

Northrop Grumman boasts a robust long-term earnings growth rate of 10.1%. The Zacks Consensus Estimate indicates a 4.5% growth in its 2024 sales compared to the previous year.

General Dynamics’ Ordnance and Tactical Systems division specializes in designing, developing, and manufacturing an extensive range of sophisticated weapon systems for ground troops. The company is also at the forefront of producing next-gen weapon systems for aircraft and naval applications. Notably, the division holds a dominant position in supplying missile subsystems that are vital for U.S. tactical and strategic missiles.

General Dynamics flaunts a impressive long-term earnings growth rate of 10.8%. The Zacks Consensus Estimate predicts an 8.9% growth in its 2024 sales compared to the previous year.

RTX’s Missiles & Defense arm is a key player in the design, development, integration, production, and maintenance of integrated air and missile defense systems. The innovative technology it offers bolsters the combat capabilities of the world’s most advanced fourth and fifth-generation aircraft across all mission phases.

RTX boasts a commendable long-term earnings growth rate of 10.2%. The Zacks Consensus Estimate suggests a 5.7% growth in its 2024 sales compared to the previous year.

Stock Movement

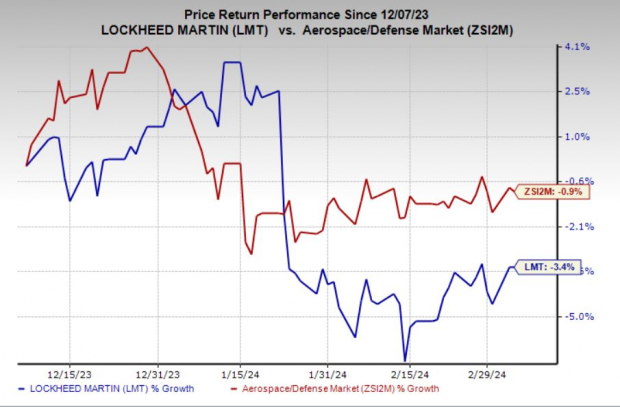

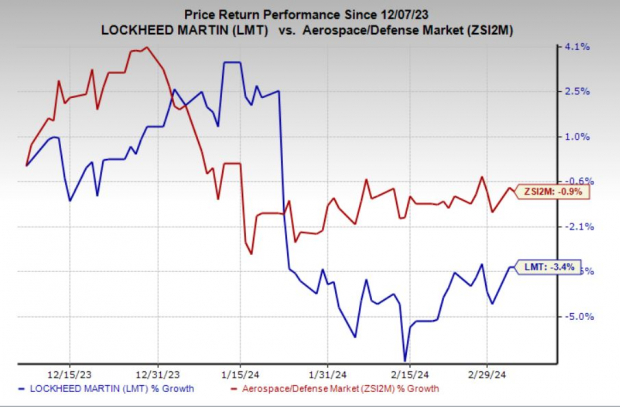

Over the last three months, Lockheed’s stock has dipped by 3.4%, in contrast to the industry average decline of 0.9%.

Image Source: Zacks Investment Research

Zacks Assessment

Presently, Lockheed is rated as a Zacks Rank #3 (Hold). To explore the entire list of today’s Zacks #1 Rank (Strong Buy) stocks, visit this link.

Merely $1 to Unlock All of Zacks’ Insights

In a surprising move several years back, we enticed our members with a 30-day access pass to all our recommendations for a mere dollar. No hidden obligations to continue.

Thousands availed of this unique chance. Thousands remained apprehensive, perhaps sensing a catch. To be candid, there was. We aimed to introduce you to our array of portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. So far in 2023 alone, these services have pocketed 162 double- and triple-digit gains.

The author’s viewpoints shared herein are reflections of personal opinions and do not necessarily mirror those of Nasdaq, Inc.