We routinely turn our lenses to examine the top ten holdings of closed-end funds and exchange-traded funds, as these typically represent the largest positions in the fund – providing valuable insights into the fund’s predominant investment portfolio. With the closing of 2023 on the horizon and the dawn of a new year, the timing feels just right for an update, especially considering the significant period that has elapsed since the last revelation of my top closed-end fund positions.

The Whittling Down to Top 10

My entire closed-end fund portfolio encompasses 41 positions, reflecting a strategic selection of funds considered to be potentially long-term investments. However, I maintain a separate account for more tactical positions, further amplifying the complex chore of tracking approximately 50 CEF positions at any given time. Despite the temptations the market may present, I exercise caution in adding new names to this already extensive list, given the meticulous oversight required.

As of December 22, 2023, my top ten holdings constitute an impressive 36.52%, representing my high-conviction investments. Delving into the top 20 positions would bring the total closer to 64%. This allocation has evolved from a weightier 40.66% earlier in the year.

While the broader market has experienced fluctuations in valuations, my investment strategy remains resolute. I am inclined to divest only when confronted with significantly overvalued holdings, and as such, I incrementally add to my portfolio during periods of lower valuations.

Amidst the evolving investment landscape, I have remained steadfast in my dedication to de-risking the portfolio – a strategic maneuver that has led to a shift in my investment emphasis towards non or low-leveraged funds. The goal is to position myself advantageously in the event of a potential downturn in the interest rate environment, fostering a more resilient financial position.

Without further ado, here are my top ten CEF holdings as of December 22, 2023.

Even after a little over 10 months since the last update, the changes in my portfolio have been relatively modest, maintaining a semblance of continuity from the earlier part of the year.

Cohen & Steers Real Estate Opportunities and Income Fund (RLTY) relinquished its top position to abrdn Global Infrastructure Income Fund (ASGI), with the latter now representing my largest position. This shift in rankings, however, doesn’t signify a seismic change, as the allocation percentage experienced a subtle decrease from 4.86% to 3.86%. Also worthy of note is the presence of familiar names such as BlackRock Health Sciences (BME), BlackRock Enhanced Equity Dividend Fund (BDJ), Cohen & Steers Quality Income Realty Fund (RQI), and Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund (PTA) among the top echelons of my portfolio.

Additionally, NXG NextGen Infrastructure Income Fund (NXG), formerly known as The Cushing NextGen Infrastructure Income Fund with the ticker “SZC,” has solidified its position within the top ten, bringing the total number of steadfast funds to six.

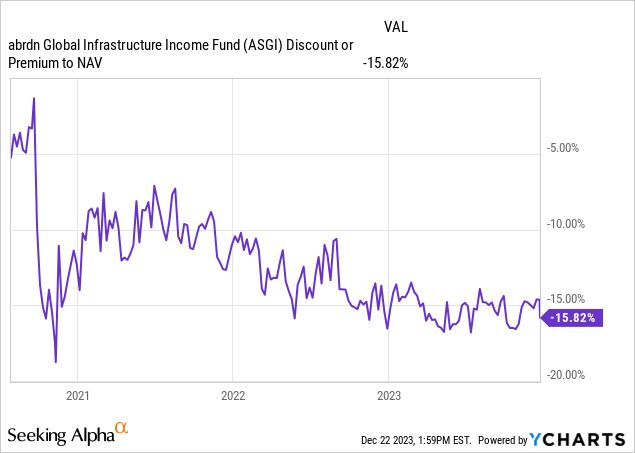

The ascension of abrdn Global Infrastructure Income Fund (ASGI) to the top rank is a testament to my fervent commitment to bolstering this non-leveraged fund. The strategic increase in this utility-focused fund mirrors my confidence in its resurgence, even amidst the prevailing market turbulence, underpinning the notion of securing a position in a discounted sector.

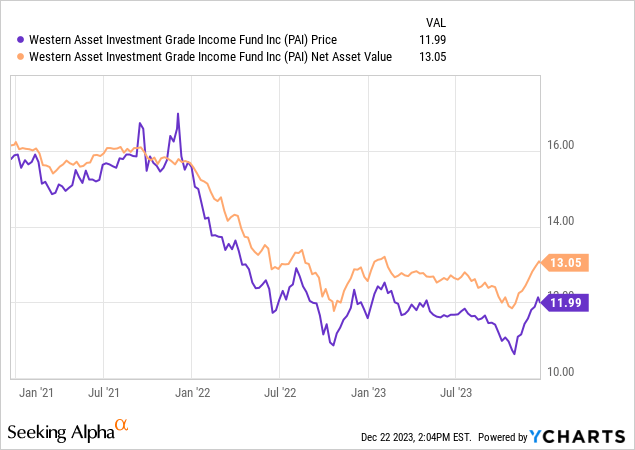

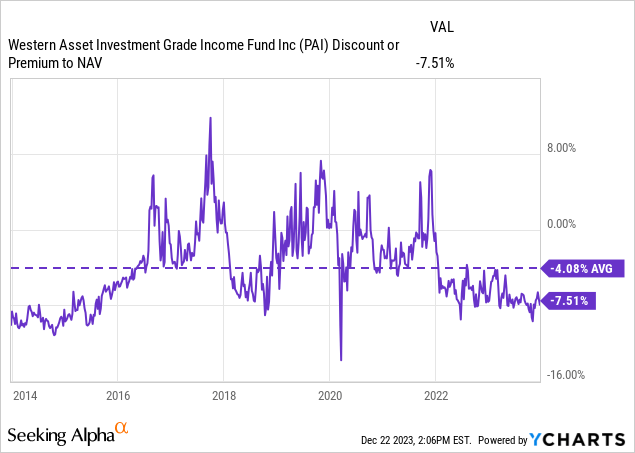

Another pivotal inclusion in my portfolio has been Western Asset Investment Grade Income Fund (PAI), which has carved its niche as the seventh-largest position. The strategic accumulation of this conservative investment-grade corporate bond fund is reflective of a blend between a tactical position and a long-term holding, tailored to capitalize on favorable interest rate movements.

As the year draws to a close, my unwavering commitment to navigating the nuances of the CEF space persists, culminating in a portfolio that reflects prudent investment choices and an astute reading of the market dynamics.

As we forge ahead, the potential headwinds and tailwinds in the investment landscape beckon, instigating a discerning approach to strategic positioning, and a resolute commitment to steering through the cyclical undulations of the financial market.

Shifting Investments in CEF Structure: A Clever Play

When interest rates were being increased aggressively and risk-free rates were going higher, the fund was hit hard. With rates expected to come down moving forward and already seeing the risk-free rate enter an almost freefall, the opposite should happen.

Being in the CEF structure allows for a discount/premium to exploit. In this case, the fund is running a relatively deep discount. That could further see some additional upside potential in this fund.

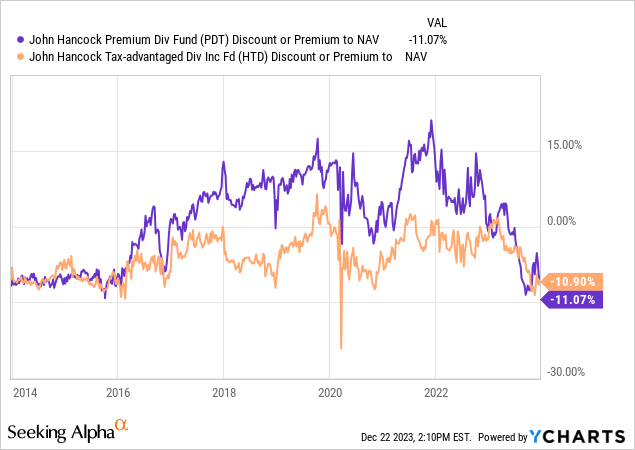

Holding the John Hancock Tax-Advantaged Dividend Income Fund (HTD) for years, an opportunity arose when a distribution cut for PDT resulted in it becoming much more attractively valued relative to its sister fund.

PDT climbed back quickly but ultimately remained more attractively valued for the author. This adjustment, made with astute timing, illustrates the dynamics at play within the portfolio.

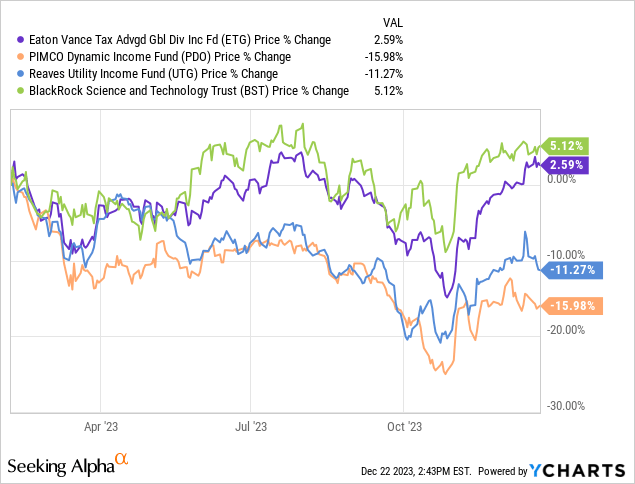

While BlackRock Science and Technology Trust (BST), PIMCO Dynamic Income Opportunities Fund (PDO) and Reaves Utility Income (UTG) continue to be part of the portfolio, their positions have shifted due to market dynamics rather than intentional selling.

The addition of Eaton Vance Tax-Advantaged Global Dividend Income Fund (ETG) into the top ten was the culmination of strategic repositioning, including increased exposure, following a previous update.

Increased exposure was also supported by relatively poor performances by PDO and UTG, and a respectable performance by BST, indicating the strategic foresight behind the fund adjustments.

Conclusion

The shifting positions of ASGI, PAI, ETG, PDO, and UTG within the top ten reflect a savvy approach to capitalizing on market conditions and the relative attractiveness of different funds within the author’s holdings. The addition of PDT, as a result of a strategic swap from HTD, further exemplifies the author’s shrewd navigation of the investment landscape.