Mutual Funds

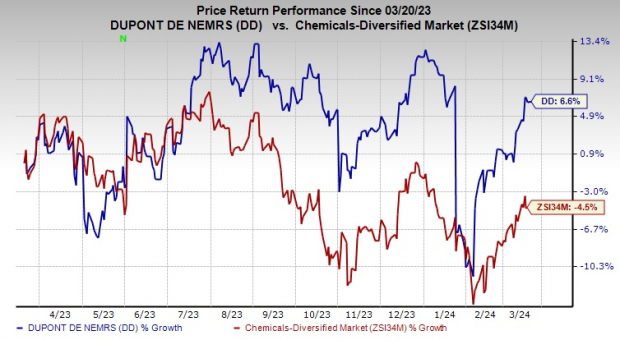

DuPont (DD) Partners Menatek in the Global Bearing Market

Innovative Partnership Propels DuPont With Menatek in the Bearing Market

DuPont de Nemours, Inc. DD and Menatek Defense Technologies have joined forces to revolutionize the realm of bearings with the cutting-edge NAZ Bearings. These ...

Revolutionary RFS1140 Makes Waves: Mercury Systems Launches Early Access Program

The Dawn of Innovation Mercury Systems has unveiled its early access program for the groundbreaking RFS1140 direct RF System-in-Package, poised to redefine electronic warfare, ...

Anticipating SolarEdge (SEDG) Fourth Quarter Earnings Report

On February 20, SolarEdge Technologies, Inc. (SEDG) is set to announce its Q4 and full-year 2023 results post-market close. In the preceding quarter, the ...

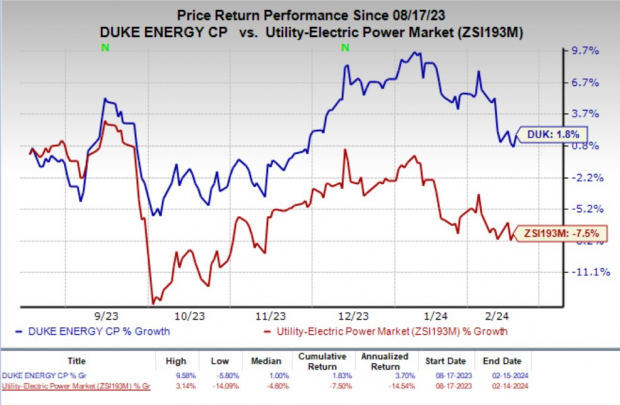

Reasons to Add Duke Energy (DUK) to Your Portfolio Right Now

Why Duke Energy (DUK) Deserves a Spot in Your Portfolio

Duke Energy’s solid investment plan over the next five years to maintain and upgrade its infrastructure should boost the company’s performance. It will further ...

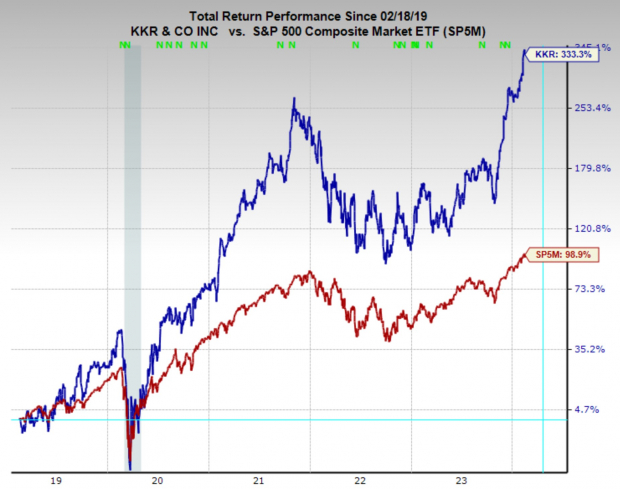

Bucking the Trend: KKR & Co. (KKR)

Bucking the Trend: KKR & Co. (KKR)

KKR & Co. KKR is a leading global investment firm, with a long and successful history in the private equity industry. KKR & Co. operates a ...

Eastman and Rumpke Partner to Expand PET Waste Recycling

Eastman and Rumpke Partner to Expand PET Waste Recycling

The global plastic waste challenge has found a formidable opponent in the alliance formed between the Eastman Chemical Company (EMN) and Rumpke Waste & ...

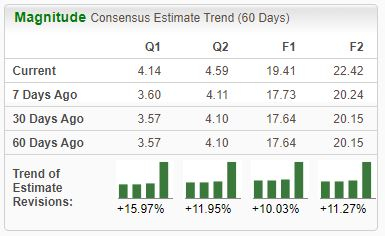

Bull of the Day: Meta Platforms (META)

Investors Rejoice as Meta Platforms (META) Skyrockets 30% in 2024

The Rise of Meta Platforms A member of the beloved ‘Magnificent 7’, Meta Platforms META has rewarded shareholders handsomely, up an astounding 30% just ...

Trinity Biotech (TRIB) to Harness Wearable Biosensor Technology in Waveform Technologies Acquisition

Trinity Biotech (TRIB) to Harness Wearable Biosensor Technology in Waveform Technologies Acquisition

Trinity Biotech (TRIB) has struck a precise agreement to purchase the biosensor and Continuous Glucose Monitoring (CGM) assets of Waveform Technologies, catapulting the company ...

Canadian Pacific (CP) Q4 Earnings Exceed Projections, Surge Year Over Year

Canadian Pacific (CP) Q4 Earnings Exceed Projections, Surge Year Over Year

Canadian Pacific Kansas City Limited CP astounded investors by surpassing expectations, reporting fourth-quarter 2023 earnings (excluding 6 cents from non-recurring items) per share of ...

Beware The Bull in RH (RH) Company Stock

Beware The Bull in RH (RH) Company Stock

The Luxury Furniture Lull RH (also known as Restoration Hardware), is a luxury home furnishings company known for its high-end and curated collections of furniture, ...