Allison Transmission Holdings has astounded investors with its fourth-quarter 2023 earnings of $1.91 per share, reflecting a staggering 25.6% year-over-year increase. This news smashed through the Zacks Consensus Estimate of $1.42, signifying a professional mic drop of sorts. Driving this monumental performance were the North America On-Highway, Defense, and Outside North America Off-Highway end markets, all eclipsing their anticipated sales. Now, that’s what I call knocking it out of the park. The icing on the cake? Record quarterly revenues of $775 million, representing an 8% increase over the previous year and surpassing the Zacks Consensus Estimate of $755 million.

This electrifying news sent shares of ALSN soaring approximately 14%, allowing it to close at a riveting $70.10. The stock currently enjoys a Zacks Rank #2 (Buy). For those of you noting this meteoric success, see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

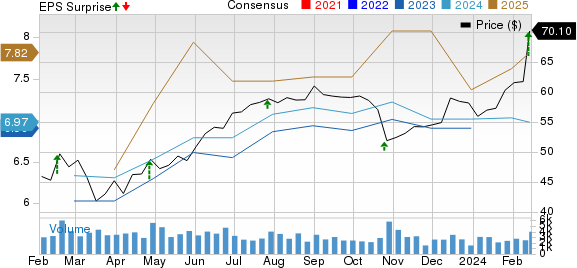

Allison Transmission Holdings, Inc. Price, Consensus and EPS Surprise

Allison Transmission Holdings, Inc. price-consensus-eps-surprise-chart | Allison Transmission Holdings, Inc. Quote

Segmental Performance – A Closer Look

Let’s delve deeper into the end markets served by Allison to truly appreciate the exceptional performance that unfolded:

In the reported quarter, net sales in the North America On-Highway end market experienced a jaw-dropping rise of 14% year over year, clocking in at $380 million and surpassing the Zacks Consensus Estimate. This stellar growth was fueled by rampant demand for Class 8 vocational medium-duty trucks, leading to some serious sales outperformance.

However, no party is without a wallflower. The North America Off-Highway end market saw net sales plummet by 79% to $5 million from the year-ago period, missing the consensus mark. Not every market can be a belle of the ball, after all.

The Defense end market had its time to shine with a dazzling 34% ascend in net sales to $63 million against the Zacks Consensus Estimate, primarily driven by escalating demand for Tracked and Wheeled vehicle applications. Shine bright like a diamond, indeed.

On the flip side, the Outside North America On-Highway market witnessed net sales dip to $128 million, a decrease from the $131 million generated in the same quarter of 2022. The reported figure fell short of the consensus mark, proving that not every market could bring home the bacon.

Meanwhile, the Outside North America Off-Highway end market experienced a euphoric 31% surge in net sales to $38 million, surpassing the Zacks Consensus Estimate, all thanks to high demand in the mining sector. Who doesn’t love a Cinderella story?

Lastly, net sales in the Service Parts, Support Equipment & Other end markets enjoyed a respectable 4.5% year-over-year growth, reaching $161 million and aligning with the consensus estimate.

Financial Position – A Glimpse Behind the Curtain

Allison seems to have struck gold with a gross profit of $371 million, reflecting a surge from the $338 million raked in during the same period in 2022. This monumental leap was chiefly driven by price hikes in certain products.

The quarter also saw adjusted EBITDA amounting to a solid $277 million, marking an uptick from $245 million a year ago. This commendable growth was steered by a higher gross profit.

Not to mention, selling, general and administrative expenses took a tumble to $92 million from $97 million in the same period in 2022, spotlighting an impressive feat in cost management. Meanwhile, engineering – research and development expenses significantly rose to $54 million compared with $49 million recorded in the corresponding quarter of 2022. Talk about balancing act!

Closing out the finances, Allison flaunted cash and cash equivalents of $555 million on Dec 31, 2023, marking a substantial leap from $232 million at the end of 2022. Long-term debt stood at $2,497 million, slipping marginally from $2,501 million as of Dec 31, 2022.

The cherry on top? Net cash provided by operating activities hit a solid $238 million. Adjusted free cash flow in the reported quarter soared to $186 million, up from $132 million generated in the year-ago period. During the quarter, the company awarded its stakeholders with a quarterly dividend of 23 cents per share and also bought back shares worth $105 million.

2024 Outlook – Peering into the Crystal Ball

Looking ahead, Allison anticipates full-year 2024 net sales landing in the ballpark of $3.05-$3.15 billion. Net income is expected to fall within the range of $635-$685 million. Adjusted EBITDA is estimated to hover between $1.07-$1.13 billion. Furthermore, net cash provided by operating activities is projected to range from $700 million to $760 million, while capex is set to clock in at $125-$135 million. Not to mention, adjusted free cash flow is forecasted to rest at $575-$625 million. Could these projections be the magic beans leading to the goose that laid the golden egg?

Peer Releases – Everyone Loves a Cinderella Story

Autoliv (ALV) took center stage with its fourth-quarter 2023 results, dazzling investors with adjusted earnings of $3.74 per share that surpassed estimates and leaped 105% year over year. The company reported net sales of $2,751 million in the quarter, eclipsing expectations and soaring 18% year over year. Cash and cash equivalents stood at $498 million as of December 31, 2023, while long-term debt totaled $1.32 billion. Autoliv also forecasts full-year 2024 organic sales growth of around 5%, along with an anticipated adjusted operating margin of approximately 10.5% and expected operating cash flow of $1.2 billion in 2024. Talk about a performance fit for a fairy tale!

Oshkosh Corp (OSK) made its own waves with adjusted earnings of $2.56 per share, surpassing estimates and marking an impressive rise from the year-ago period. Consolidated net sales in the quarter climbed 12% year over year to $2,466.8 million, although the top line marginally missed the Zacks Consensus Estimate. The company boasted cash and cash equivalents of $125.4 million as of December 31, 2023, with long-term debt tallying $597.5 million. Oshkosh foresees full-year 2024 sales of around $10.4 billion, along with expected diluted earnings of $9.45 per share and adjusted earnings of $10.25 per share—an ending fit for a corporate Cinderella story, if you ask me.

BorgWarner (BWA) unveiled its fourth-quarter 2023 results, showing adjusted earnings of 90 cents per share, down from the prior-year quarter. The bottom line missed estimates, as did net sales, which declined 14.4% year over year. As of December 31, 2023, BorgWarner had $1.53 billion in cash/cash equivalents/restricted cash, with long-term debt standing at $3.71 billion. The company looks forward to 2024 with an anticipated net sales range of $14.4-$14.9 billion, an adjusted operating margin expected in the range of 8.5-8.9%, and estimated adjusted earnings within the band of $3.65-$4 per share. Could this be a corporate cautionary tale, or is there still a happily ever after for this industry player?

Zacks Names “Single Best Pick to Double”

From thousands of stocks,

Zacks Director of Research Identifies a Promising Medical Breakthrough Stock

At Zacks, the most tantalizing discoveries often come from the most discriminating sources. In a forum where investment gurus tout stocks with the fervor of carnival barkers, the utterances of the Director of Research carry the most weight. With a discerning eye for investments, he has chosen a stock he believes has the potential to skyrocket by a staggering 100% or more in the months ahead.

A “Watershed Medical Breakthrough” Unveiled

What makes this stock stand out? Whisperings from the Zacks camp paint the company as a harbinger of a “watershed medical breakthrough.” The company is not merely treading water; it is crafting a bustling pipeline of projects with the potential to alleviate the suffering of patients grappling with liver, lung, and blood-related ailments. Eager investors are presented with a timely opportunity to grab a stake in this company as it ascends from the depths of a bear market.

Competitive Advantage

This stock is not merely promising; it is positioned to rival, and perhaps surpass, recent stocks that have doubled, such as the Boston Beer Company, which soared by a remarkable 143.0% in a little over nine months, and NVIDIA, which experienced an astounding 175.9% surge in just one year.

Claim Your Exclusive Insights Here

Embark on your quest for wisdom, maintained by our dedicated team of Zacks experts. With the latest recommendations from Zacks Investment Research, you can download the report containing the 7 Best Stocks for the Next 30 Days. Best of all, this valuable report can be yours absolutely free. Click below to get started.

For further in-depth analysis, feel free to peruse our latest stock reports:

Autoliv, Inc. (ALV) : Free Stock Analysis Report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.